Financial institutions, such as NBFCs or NBFIs (non-banking financial companies/institutions), have been steadily moving towards digital lending systems, but just as that shift was becoming the norm, AI changed the pace.

AI in lending has become a core feature for financial institutions, helping with everything from approving loan applications to forecasting risks and offering personalized lending product suggestions to individual buyers with the loan management system. And it’s assisting them in doing all of this efficiently, quickly, and with scalability.

In this blog, we will explore which are the most effective AI trends that are primarily shaping the finance industry in 2025. Let’s straight dive into the concept:

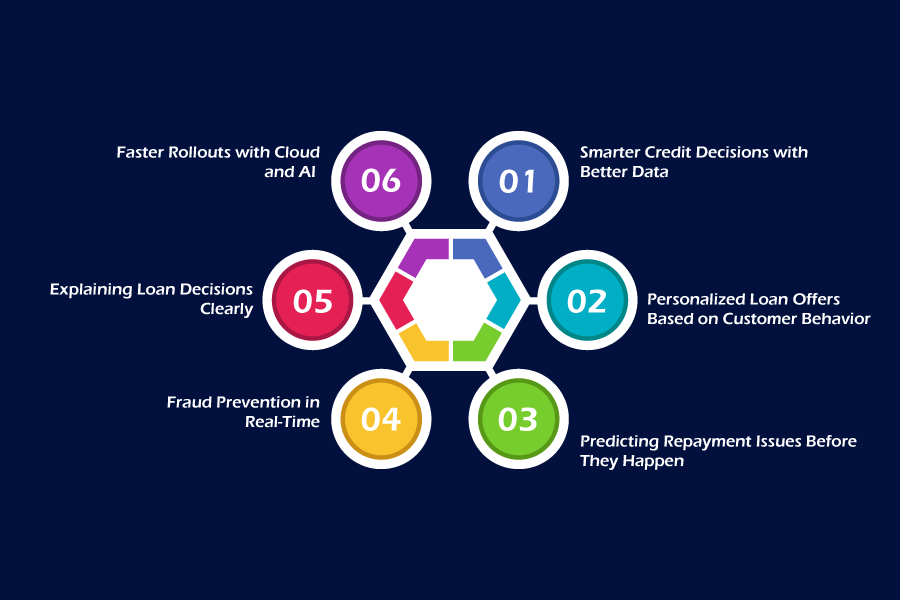

Top 8 AI Trends for Financial Institutions in 2025

From streamlining approvals to minimizing risk and offering a more personalized borrowing experience, AI is transforming every step of the lending journey. Let’s discuss which key AI trends are transforming the experience in 2025:

Smarter Credit Decisions with Better Data

Traditionally, NBFCs or banks would rely mostly on credit scores and past bank statements to approve loans. But in 2025 and beyond, , AI goes deeper — helping NBFCs assess things like utility bill payments, UPI activity, digital wallet usage, and more.

This expands credit access also to borrowers with little or no formal credit history, while reducing lender risk.

According to Deloitte India, “NBFCs using AI-based credit models saw a 30–35% increase in loan approval accuracy and 25% fewer bad loans.” Source

Personalized Loan Offers Based on Customer Behavior

Every borrower is different! Some prefer lower EMIs, some repay early, while others need funds only during a certain period of the year, such as festivals or the school season.

AI tracks these behavior patterns in real time and enables NBFCs to offer flexible, personalized loan plans, such as flexible repayment plans, based on real-time customer behavior. This makes customers feel seen and understood, improving conversions.

In fact, “some NBFCs using personalized lending through AI have seen up to a 35% increase in loan approvals and repeat customers.”

Predicting Repayment Issues Before They Happen

AI is not just improving loan approvals; it’s helping NBFCs manage repayments proactively.

Today, many lenders are using AI to detect early signs of repayment trouble. These could be sudden drops in spending patterns, salary delays, or even reduced app activity. Once AI detects these risks, it can trigger automated reminders or suggest alternate payment plans or support offers to avoid defaults.

PwC reports, “NBFCs using AI-based repayment tracking saw up to 40% improvement in on-time collections.” Source

Fraud Prevention in Real-Time

With the rise of digital lending, fraud attempts have also surged; however, AI is helping NBFIs stay proactive. Modern systems detect fake documents, identify multiple applications from a single device, biometric data, transaction context, and identify suspicious behavior before approving a loan application.

This real-time fraud detection is already saving millions of dollars in potential losses – becoming the front-line defense in NBFC fraud control.

Explaining Loan Decisions Clearly

Nothing frustrates borrowers more than a “Loan Rejected” message with no explanation, but today that’s no longer a scenario. AI-powered systems now include Explainable AI (XAI), which let lenders provide clear and simple reasons for loan decisions.

So instead of just “Loan Rejected,” a borrower sees something like, “We noticed high credit card usage recently, which impacted your score.”

This builds trust and helps customers know what to improve to align with regulatory compliances. Lenders adopting XAI are seeing fewer complaints and faster customer dispute resolutions. This concept is backed by frameworks like LIME and SHAP, proven effective in real-world credit models.

Faster Rollouts with Cloud and AI

To make the most of AI, NBFIs are also shifting their systems to the cloud. Cloud platforms let lenders update loan policies, risk models, and customer workflows within a few days.

This agility reduces IT costs and allows scaling the lending business faster. This combination of cloud and AI is especially useful for NBFIs looking to expand into new regions or serve a growing customer base.

Embedded Lending

Not just on an NBFC’s website or app, in 2025, customers expect loan options to be available whenever and wherever they need them. With AI, lenders are now offering credit through shopping apps, travel portals, education platforms, and more.

This is called embedded lending, and it’s becoming one of the fastest-growing lending trends. Customers benefit from instant access to loans, and lenders are reaching customers they otherwise wouldn’t on their own platforms.

Ensuring AI Remains Unbiased

With all the efficiencies, NBFIs must ensure the use of AI remains ethical through following ways:

- It means that AI decisions must be fair across gender, geography, or income groups.

- Moreover, it should also maintain transparency regarding how the customer’s data is being used.

- Institutions should integrate AI audit trails, bias checks, and consent-based data collection software into their systems to maintain the trust and credibility of AI in digital lending.

Although AI is creating a significant impact on modern NBFIs’ lending process, however, there is more of it yet to unfold. What today looks smarter, faster, and dynamic in AI would have a broader shift in the future and would offer more inclusive experiences to the loan buyers. However, AI in mobile lending would only work for NBFIs, who would implement it efficiently with a trend-adaptable setup.

Final Words

AI in lending has brought a significant shift in how lending works and what customers expect. For NBFCs, 2025 is about using AI to build faster, safer, and more customer-friendly lending systems.

Whether it’s approving a microloan within minutes or helping a customer stay on track with repayments, AI is changing the lending experience end-to-end. But the key is using AI with intention, aligning automation with human expertise, and balancing business goals with long-term customer trust.

Hence, at Lendmantra, we help NBFCs adopt AI in ways that make lending smarter and simpler, for everyone involved. Our ready-made but easy-to-customize AI-integrated lending setups allow you to scale and deliver an elevated customer experience. If you’re ready to future-proof your lending model, let’s connect and initiate a way to success in the modern lending market.

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

What are the top AI trends in the NBFC sector to watch this year?

The top AI trends in the NBFC sector to watch in 2025 are:

- Quality Data and Smarter Credit Decisions

- Personalized Loan Offers Based on Customer Behavior

- Predicting Repayment Issues Before They Happen

- Fraud Prevention in Real-Time

- Explaining Loan Decisions Clearly

- Faster Rollouts with Cloud and AI Together

- Embedded Lending

- Integrated Features that Encourage Unbiased AI Efficiencies

How does AI-driven automation enhance loan origination and approval?

AI-driven automation streamlines the entire lending process, with ensured accuracy and reduced risks. It automates tasks such as document processing, data extraction, and credit scoring that resulting in faster loan approvals and credit access.

How does AI improve the borrower experience in digital lending platforms?

AI facilitates borrowers with a faster loan process, personalized offers, improved customer service, and enhanced security. It also fosters transparency related to the entire lending process, loan approval, and offers customers tailored loan products.

What should NBFCs consider before implementing an AI-powered lending solution?

Fintech is booming rapidly, and so are the facilities for the buyers or their customers around diverse financial departments, and NBFCs are one of them. AI-powered lending solutions allow NBFIs to improve the lending process through a digital and automated setup, ensuring an elevated customer experience.