Non-Banking Financial Companies (NBFCs), also known as Non-Bank Financial Institutions (NBFIs), play a vital role in boosting the economies of many countries. However, with the rapid advancements in financial technology (fintech), these non-bank lenders face challenges in keeping up. Many struggle to move away from outdated systems and adopt modern software that can support their lending processes and help them gain the trust of their customers. This is especially tough for new non-bank financial institutions looking to raise funds and grow in a competitive market.

In this blog, we will look into the challenges faced by new non-bank financial institutions and how digital solutions can resolve them with tailored software options.

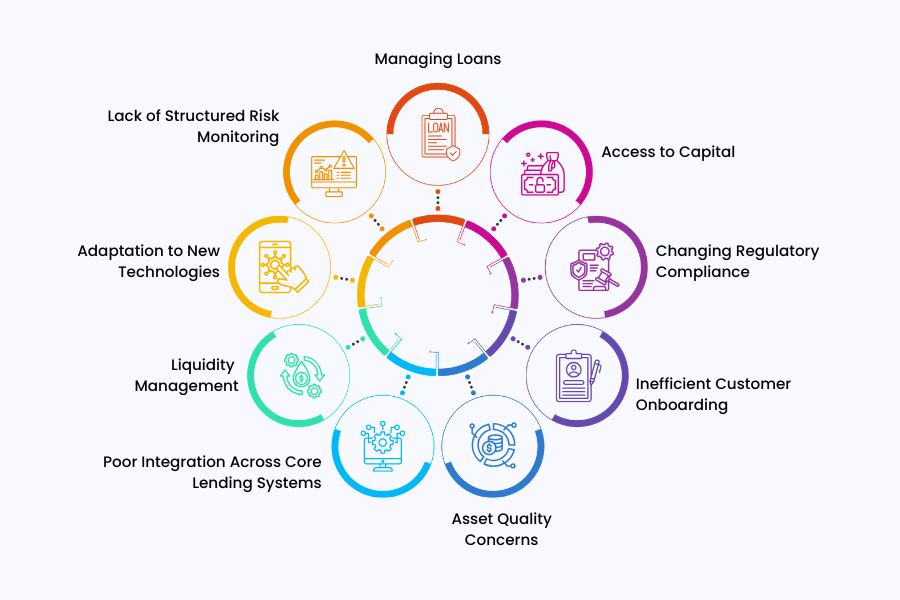

Understanding the Challenges Faced by NBFCs

As the financial market continues to grow and change, non-banking financial companies (NBFCs) face ongoing scrutiny regarding their trustworthiness. Several factors, including shifting regulations, access to funding, and advancements in financial technology, can make it particularly challenging for new NBFCs to succeed. If you’re considering expanding your financial business, let us aware you of these potential challenges so that you can make full use of the resources available to solve them:

Managing Loans

Most new NBFCs begin operations with basic workflows—shared drives, Excel trackers, manual approvals. But once the loan volume crosses a few hundred accounts, this approach collapses. Errors in interest calculations, missed repayment alerts, or even duplicate records become routine. Worse, without system-based controls, compliance risks go unchecked.

Access to Capital

Resources says, bank lending to NBFCs dropped to a four-year low of 6.7%, largely due to tighter credit norms and elevated risk weights. Unlike banks, NBFCs don’t have access to cheap deposits. Instead, they rely on debentures or term loans from institutions—often at double-digit interest rates.

Changing Regulatory Compliance

New NBFCs aren’t exempt from RBI oversight. The latest digital lending guidelines demand full KYC digitization, real-time reporting, and clear audit logs. Many newcomers struggle to keep up—especially if their tech infrastructure is stitched together last-minute.

Inefficient Customer Onboarding

Entering the market, new non-finance lenders many a times have saturated monetary flow, leading to reliance on time-consuming manual processes. This mostly results in inferior customer experience, delayed disbursements, and increased drop-offs. Being new to the market, if they are unable to win a loyal customer base, how would they plan on expanding?

Asset Quality Concerns

Higher default rates and inadequate risk assessment frameworks are common issues faced by new companies with traditional NBFI solutions. Over the period, the country has experienced severe economic breakdowns, resulting in a growing number of non-performing assets (NPAs).

As a result, a higher number of NPAs affects market reputation and investors’ trust, which raises fundraising concerns for Non-bank lenders. As per facts, “Fusion Finance, a microfinance NBFC, reported its fourth consecutive quarterly loss in 2025, highlighting sector-wide asset quality stress.”

Poor Integration Across Core Lending Systems

The manual data sets are created dynamically, and for the same reason, new NBFIs fail to integrate external data sources like CIBIL, payment gateways, and more. This can be due to a conventional lending setup or insufficient resources. However, it impacts their operations and leads to inefficient customer verification and lagging decision-making.

Liquidity Management

As per research, “Indian lenders have requested the RBI to reintroduce overnight liquidity operations and ease cash reserve requirements to improve short-term funding access.” First 6–12 months are crucial. A mismatch between inflows (EMIs) and outflows (new disbursals) forces founders to pause operations or seek emergency capital.

Adaptation to New Technologies

Undoubtedly, tech fosters convenience for the Non-bank lenders by allowing them to provide enhanced financial services and better customer support. The founding team often comes from finance or sales, not tech or compliance.

This leads to delayed platform adoptions, such as NBFC automation software, NBFC loan management systems, or other modern NBFC software solutions, which might cause them to fall behind in the market.

Lack of Structured Risk Monitoring

Most new NBFCs begin with informal or reactive risk practices—approving loans based on basic scores, managing collections ad hoc, and tracking liquidity only when a crisis hits. There’s often no central dashboard, no early warning triggers, and no ownership of credit or operational risk.

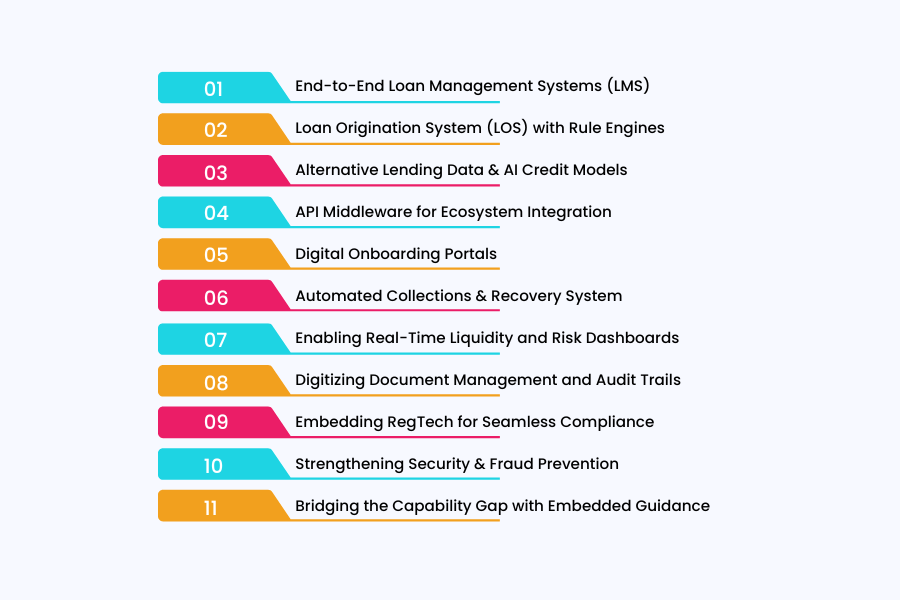

Digital Solutions That Are A Must To Overcome New NBFC Challenges

Although technology isn’t the 100% solution, the right digital solution can be a significant support in eliminating issues that crush many new NBFCs in their first 24 months. Here’s how new-age digital solutions can address the core operational and strategic issues we highlighted earlier:

- End-to-End Loan Management Systems (LMS)

A robust LMS replaces manual spreadsheets, fragmented records, and duplicated processes with a centralized, automated system. From borrower profiling to EMI scheduling and NPA tracking—everything sits on a single dashboard.

- Loan Origination System (LOS) with Rule Engines

An automated Loan Origination System (LOS) accelerates customer onboarding by handling document collection, e-KYC, credit checks, and disbursements—backed by a dynamic business rules engine. What it solves:

- Shortens onboarding TAT from days to hours

- Adapts instantly to changing RBI or internal policy changes

- Offers rule-based workflows for different borrower categories

- Alternative Lending Data & AI Credit Models

For thin-file borrowers, traditional bureau scores fall short. Integrating AI-driven scoring models that ingest alternative data—like mobile usage, digital payments, or social signals—helps lenders make smarter, inclusive credit decisions.

- API Middleware for Ecosystem Integration

NBFCs no longer operate in isolation. You need real-time connectivity with credit bureaus (CIBIL/CRIF), banks, wallets, Aadhaar verification services, GSTN APIs, and more. A secure API layer makes this seamless.

- Digital Onboarding Portals

Custom-built web or mobile interfaces for borrowers that walk them through the journey—from application to disbursal—reduce drop-offs and improve satisfaction.

- Automated Collections & Recovery System

Traditional manual collections are not scalable. According to TransUnion, AI-enabled collections boost recovery rates by 25% and cut costs by 40%.

- Enabling Real-Time Liquidity and Risk Dashboards

When cashflows are tight, NBFCs need to track disbursements, collections, and defaults in real time. Dashboards with early warning indicators, repayment alerts, and NPA flags offer visibility before crises hit.

- Digitizing Document Management and Audit Trails

Storing sensitive documents in Excel folders or email inboxes is a compliance disaster waiting to happen. Secure, cloud-based document management with role-based access and audit trails ensures information integrity and regulatory readiness.

- Embedding RegTech for Seamless Compliance

Due to rising regulatory demands, NBFCs need systems that auto-log every customer verification, transaction, and approval. Pre-built compliance templates, configurable audit reports, and alerts ensure audit readiness at all times.

- Strengthening Security & Fraud Prevention

Cyber risks are no longer a future concern—they’re an everyday reality. Access control, encryption, multi-factor authentication, and fraud detection algorithms protect both customer data and NBFC reputation.

- Bridging the Capability Gap with Embedded Guidance

Many new NBFC teams are lean, with limited tech or compliance experience. Just offering a tool isn’t enough—they need best practices, built-in workflows, and ongoing advice.

How LendMantra Is Helping New NBFCs Step into Digital Lending?

Easy liquidity flow and operating finance in the tech-driven world can even create unexpected challenges for NBFCs in the future. What makes it a must to have potential NBFC software solutions that not only enhance operational efficacy but also prepare it to tackle spontaneous regulatory or capital challenges.

As a new Non-bank financial institution, you might come across multiple challenges that can hinder your market presence and growth. However, with Lendmantra, the frame looks positively different. Our custom NBFI software solutions help new non-banking institutions to successfully build a robust foundation and ensure long-term growth in the fintech industry. From implementing loan origination software to providing an overall NBFC digital transformation, we add the keys to your pristine setups that help you unlock new clients. Experts at Lendmantra listen to your NBFI challenges, assist you on the scope of improvements, and help you with modern NBFC solutions. Don’t let your thoughts trap you in a threatening mindset that can hinder your business expansion and allow your digital competitors to surpass you. Ready to step into the competitive fintech market with Lendmantra? Connect with our experts now, where we guarantee to nurture your fintech growth with our best tech solutions for NBFC.

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does LendMantra help NBFIs with regulatory compliance?

LMS helps keep up with financial regulations by automating compliance checks and maintaining audit trails, ensuring that lenders and stakeholders remain at ease.

Why should a new NBFC consider digitizing its operations early?

New NBFCs can reduce cost, streamline operations, and scale significantly by early digitizing their operations. It delivers quality customer experiences and ensures adherence to regulatory compliance with its ever-evolving nature.

What is the typical time frame for implementing a loan management system in a new NBFI?

It highly depends on the project size, however, an expected time frame for implementing a loan management system can be one week.

How can I schedule a demo of LendMantra?

To book a demo with Lendmantra he/she can simply fill out the contact us form, available on the website, and add a message for a demo. Our team will shortly get in touch with the person.