Beware! A cybersecurity report identified 15 malicious loan apps downloaded onto at least 8 million Android smartphones worldwide. These applications, termed “SpyLoan” apps, have seen a 75% increase in activity and are considered a global threat. (resources)

Don’t be another NBFC (Non-Banking Financial Company) to be questioned for such traps! Be the most reliable lending platform with a seamless loan origination system. How? With lendmantra, one of the globally trusted AI-powered loan origination suites with over 200 satisfied clients across different globe.

But what are we doing differently? Discover the secret in this blog, till then first things first! Let’s explore the entire concept of digital loan origination and why you need it in 2025 and the future, but with caution. This blog not only educates you on how to avoid fraudulent loan origination systems but also on why only lendmantra can be your most trusted partner in delivering seamless digital loan origination services to your customers.

What is a Loan Origination System?

If you have heard of digital lending you are somewhat friendly to LOS. Let’s understand it comprehensively. LOS stands for the loan origination system. It is a software or digital platform that automates the entire lending process from start to end. Let’s cut to “how LOS works” and you will be able to understand it firmly.

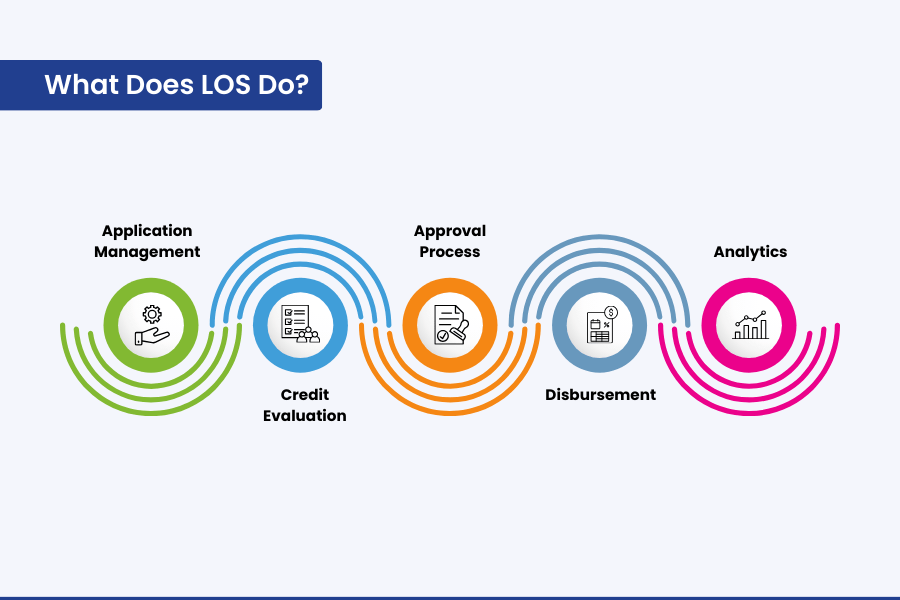

What Does LOS Do?

Understand it through this five-step process:

- Application Management: It manages all the loan applications the sales person submits on a platform integrated with LOS.

- Credit Evaluation: Its automated features and scoring models evaluate borrower’s credit credibility.

- Approval Process: The loan is approved or rejected automatically based on pre-established conditions.

- Disbursement: On approval, the loan origination process manages the loan disbursement to the account holder.

- Analytics: Tacks and gives updates on the performance of loan applications, approval rates, and borrower’s disposition.

Why are NBFCs Rapidly Opting for Digital Lending?

The future is Fintech and if NBFCs won’t opt for a reliable digital lending platform or software, probably they can’t be witnessed in the future fiscal landscape. Here are some primary reasons why the loan origination system is a vital resource in digital lending for all the finance operational bodies.

Faster Processing:

Time-taking loan processing and approval have no chance with LOS. It makes your loan approval process faster by eliminating manual processes.

Accuracy:

With an automated loan origination system, the evaluations and decisions go error-free.

Cost Efficiency:

Don’t splurge on integrating multiple software when loan origination software saves operational costs by automating repetitive tasks for lenders.

Enhanced Customer:

With quick loan approvals and a seamless lending process, you can deliver a seamless experience to borrowers that attracts even more customers.

Scalability:

Quality is never going to be an issue as the loan origination software helps lenders manage a high number of lending applications easily.

With all these features, lendmantra develops customer-integrated loan origination software for NBFCs. Our experts undermine that the LOS is customized to meet the needs of both lenders and borrowers.

We are globally known for offering accustomed loan origination system software for small, medium, and large size NBFCs. Hence, if you are still having second thoughts about switching to a potential loan origination software, then let’s delve more into this topic.

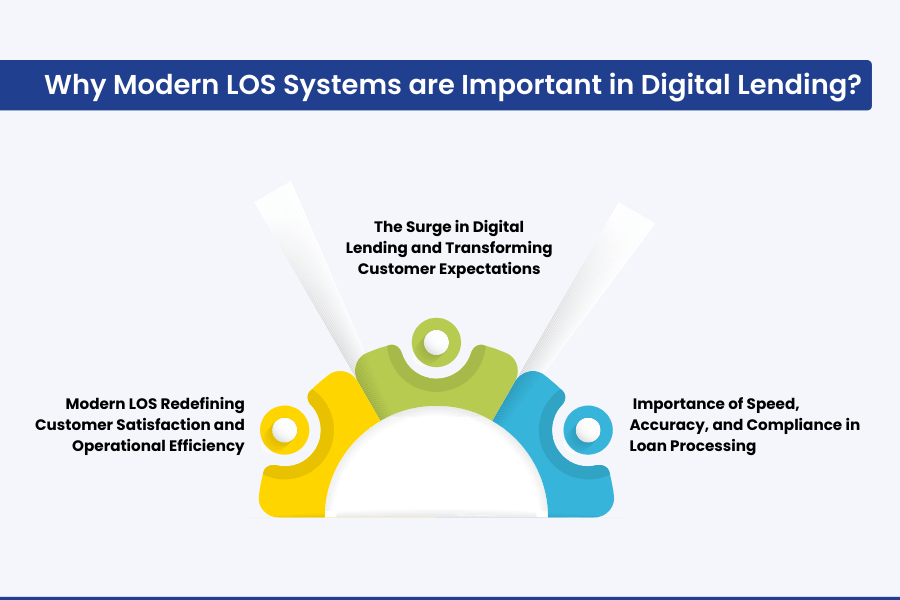

Why Modern LOS Systems are Important in Digital Lending?

You must have heard “If you don’t go along with time, the time will pass, and you will be left behind.” This theory applies in every industrial aspect and Fintech is one of them. We are rapidly evolving in finance and tech together and LOS Software for NBFCs is one of the greatest examples of it.

But! To an NBFC, why would any borrower rely on you, if your services are not reliable, quick, and can go beyond creditworthiness? Especially, when there are so many competitors in the market, providing digital lending at the borrower’s convenience with a streamlined process. All these conditions make having Loan Origination Software a must for NBFCs. Let’s check some of the vital benefits of having LOS software for NBFCs:

The Surge in Digital Lending and Transforming Customer Expectations:

Today, borrowers expect instant approvals, paperless processes, and personalized services but traditional systems fall short in meeting these demands. Modern loan origination software is designed to meet these requirements by streamlining the entire lending process and making it user-friendly. LOS software for NBFCs allows them to drive higher customer retention delivering seamless lending services.

Importance of Speed, Accuracy, and Compliance in Loan Processing:

Everyone is in a hurry and so are the borrowers. They need immediate loan approvals and quick amount disbursement. Digital lending provides real-time processing and automated credit checks. However, it is essential to verify borrower information without compromising on regulatory requirements. AI-powered loan origination software is designed to comply with constantly changing laws or updates and ensure faster loan processing with stringent security and trust.

Modern LOS Redefining Customer Satisfaction and Operational Efficiency:

Modern loan processing automation is designed to boost user satisfaction ensuring a streamlined loan process with transparency. They are planned to perform automated tasks eliminating manual paperwork and human interaction. This improves work efficiency and saves cost and time. With a faster and secure loan process, NBFCs earn loyal customers making a lending business profitable.

However, only potent LOS can help NBFCs accomplish modern digital lending requirements. Hence, lendmantra develops customized digital loan origination software and systems that are customer-oriented. They help you earn a loyal customer base making your lending services, smooth, quick, and reliable.

Moreover, you can also consult with our experts about your requirements, and they will share a tailored loan processing automation system strategy that can help you achieve your consumer expectations. Now, when talking about lendmantra being a reliable resource for LOS development services, let’s discuss this in brief.

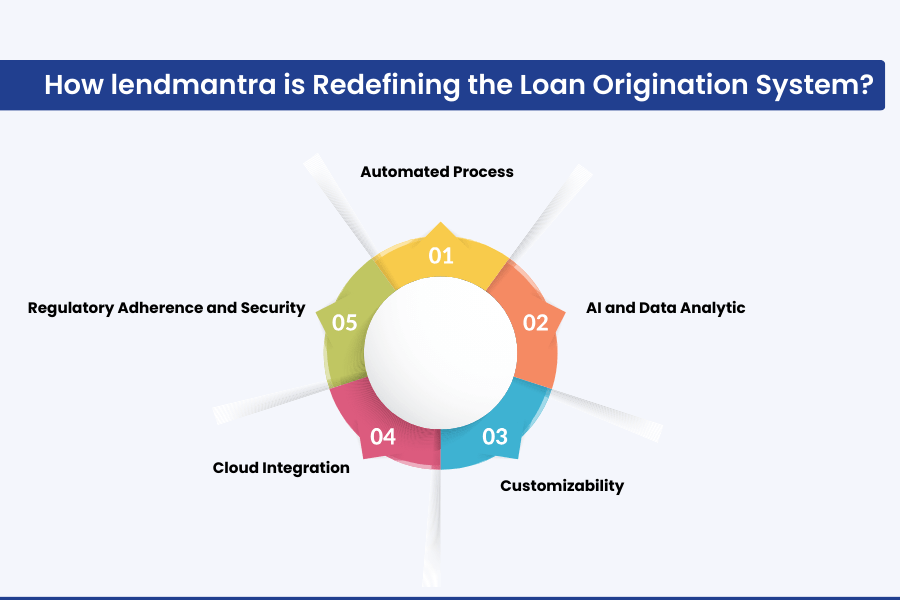

How lendmantra is Redefining the Loan Origination System?

We are the most reliable and wholesome package for NFBCs when it comes to acquiring an end-to-end loan origination solution. Here’s why:

Automated Process:

We develop a custom LOS platform that does all the repetitive tasks such as document verification, automatically. It eliminates human interaction and makes the process faster yet effective.

AI and Data Analytic:

Worried about the borrower’s behavior and risk assessment? Don’t worry we got you covered! Our AI-powered loan origination systems help lenders with predicting borrower behavior and risk assessment.

Customizability:

Custom for us is to cater to your expectations and meet your customer’s requirements. Our team offers tailored loan origination software solutions for different lenders like credit unions, and NBFCs.

Cloud Integration:

Seamless data storage with stringent security is all a streamlined LOS software needs to have borrowers trust you. Our experts build secure and scalable systems for seamless lending operations.

Regulatory Adherence and Security:

Doubting if automated systems might breach regulatory standards? We left no chance! All our LOS developments are only delivered after ensuring they comply with regulatory diligence and are firmly secure.

Don’t restrict your expectations with us till these five primary benefits, the list goes on. lendmantra favorably aims to revolutionize the digital lending landscape through LOS so that even the underserved can have an immaculate lending experience. To the ones who are already experiencing digital lending, but are struggling with mundane processes, lendmantra ensures they suffer no more!

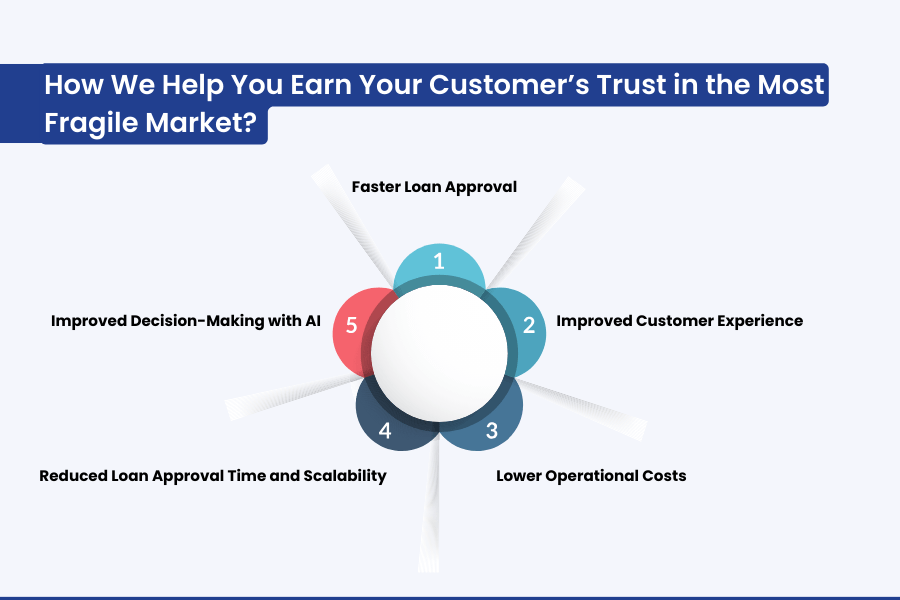

How We Help You Earn Your Customer’s Trust in the Most Fragile Market?

When you partner with lendmantra, your aim is ours too, and we understand fintech is an extremely fragile market! Hence, we initiate a trust-building approach by adding all such features to the loan origination system software we prepare for you. Wondering how we do it? Let’s explore:

Faster Loan Approval:

Borrowers are relying on digital lending because they don’t want to be a part of a lengthy loan approval or rejection process. Hence, we build LOS software that ensures faster loan approvals, saving your’s as well as the borrower’s time, simultaneously.

Improved Customer Experience:

We create LOS software that serves a seamless lending experience with transparency and real-time updates throughout the process. This enhances user experience along with a track of their application.

Lower Operational Costs:

One of the benefits of AI in loan origination systems is that they are prepared to work efficiently but at an inferior cost. The entire process eliminates manual tasks and is performed automatically, from application submission to loan disbursement. So, No more splurging!

Reduced Loan Approval Time and Scalability:

Digital lending integrated with loan processing automation by lendmantra helps borrowers with quicker loan approval. This helps them with prompter loan solutions and you with enhance customer retention rate. After all, a borrower seeks reliable and rapid lending solutions and when you give it all, they can resist your lending services.

Improved Decision-Making with AI:

Human intervention does not just make the lending process time-consuming but also increases the possibility of errors and fraud. However, AI-powered loan origination systems help NBFCs with improved decision-making by verifying documents, assessing creditworthiness, and risk assessment.

Do you see, with what efficacy you can be the most trusted lending source for borrowers seeking digital lending in India? Only with lendmantra.

Now, What’s Ahead?

Ahead is the future of the borrowers who aim for swift and end-to-end loan origination solutions. With lendmantra and its revolutionizing LOS solutions, you not only set a benchmark in the fintech or lending industry but also, become a home to the instant loan seekers. It also helps NBFCs to scale their business and earn loyal customers.

Above all, when you help people with prompt loan solutions, you also play a crucial role in easing human financial struggle on the ground level. If you have that broader vision then lendmantra is in your Service. Let’s Connect To Discuss Your Vision Briefly!

How does a LOS improve loan processing times?

The loan origination software (LOS) greatly reduces the processing time required for loans by automating repetitive tasks and streamlining the workflow. Different critical processes such as applicant review, document verification, and credit scoring, are embedded in the system and put to work with reduced people involvement for timely approval timelines.

lendmantra's LOS ensures that external database information is quickly integrated into the system, providing instant KYC verification with a credit check, and decreasing manual intervention in delays. Rapid and accurate assessment using an AI-powered decision-making tool allows financial institutions to process loan applications quickly. The automation of most of these time-consuming steps within an LOS can reduce loan cycles from weeks down to a mere few hours or days resulting in highly beneficial gains for both lenders and borrowers.

Is lendmantras LOS customizable for financial institutions?

Indeed, lendmantra provides customizable loan origination software, ensuring that they meet the needs of financial institutions. With us, you can accustom your workflows, loan products, and approval or rejection patterns aligning with unique business models. Our flexible configuration tools allow NBFCs to tailor their credit policies, risk assessment standards, and other compliances. Additionally, our modular setup allows swift integration with existing CRMs.

What are the benefits of using a LOS for trading and financial institutions?

Here are the benefits of using the loan origination software for trading and financial institutions:

- Faster loan approvals.

- Improved accuracy and regulatory adherence.

- Risk Mitigation

- Operational Efficiency

- Flexibility and Customizability.

- Real-time reporting and insights.

- Elevated customer-experience.

Wondering what else, connect with the experts at lendmantra and let all your doubts be resolved.