The last few years have witnessed substantial transformation in the lending industry, with technology remaining at the center stage, enhancing operational efficiency, customer experience, and regulatory compliance. Technological innovations like NBFC Software are among the primary factors driving this shift.

In 2025 NBFC Software, India is changing the financial world by streamlining loan origination, digital lending, and loan management. In this blog, we will explore how FinTech is changing the lending landscpae for NBFCs and what are the primary factors which can elevate the lending experience for NBFCs and the borrowers.

Role of NBFC Software in Transforming the Lending Industry in 2025

Financial sectors, especially NBFCs, are weighed down by processes, paperwork, and prolonged approvals. Today, however, NBFC software in India relies on modern-day loan management processes that are entirely seamless, automated, and digitized, which greatly enhances loan management and processing efficiency.

Digital lending solutions are now equipped with a loan management system and loan origination system, which have made increased streamlined workflows possible and fostered better risk assessment procedures and much more significant decision-making.

With the competition increasing, NBFCs must leverage modern fintech solutions to stay ahead. AI in lending allows NBFCs to tailor loans for individual customers, assess creditworthiness with great accuracy, and improve fraud detection. Artificial intelligence in lending has opened possibilities through which NBFCs can customize and personalize loans for potential borrowers and can afford high creditworthiness assessments, and fraud detection mechanisms.

In 2025, FinTech is not just all about options for NBFCs but a necessity enabling financial institutions to run at scalable parameters while maintaining regulatory compliance. Now let’s gradually learn about how NBFC software drives so much efficiency in the leading industry. Here are the technologies and advanced features that make NBFC software a key player in fostering seamless lending services.

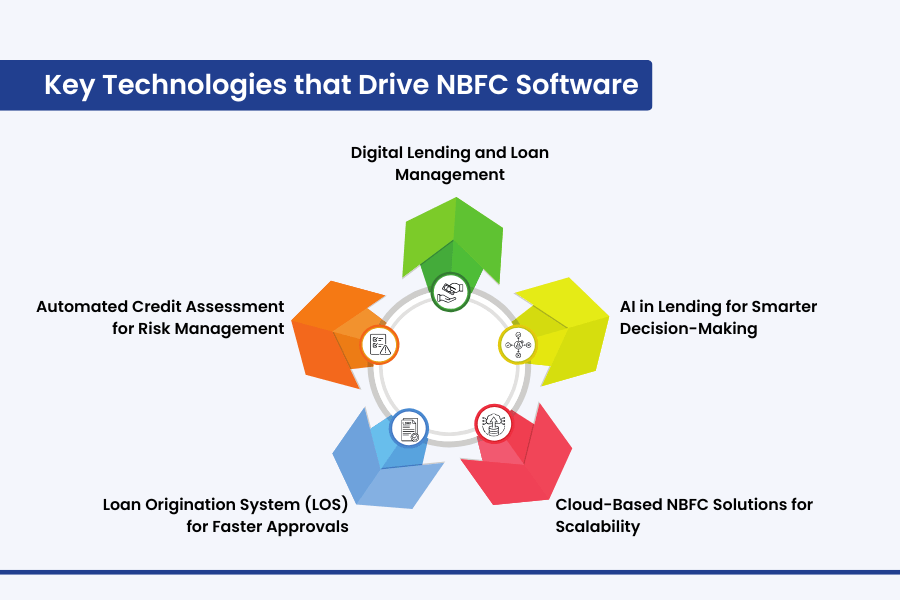

Key Technologies that Drive NBFC Software

Delivering a seamless lending experience has always been a challenge and aspiration for NBFCs. Amid this, NBFC software has enabled them to deliver exceptional loan management and fund credit solutions. Not only this, NBFC software comes packed with multiple features that elevate user experience and operations efficiency for NBFCs. Here is what makes NBFC software an exceptional solution:

Digital Lending and Loan Management

- Digital lending has revolutionized how NBFC operates. This allows these companies to automate other processes such as loan approval, disbursement, and repayment tracking through loan management software (LMS). All manual paperwork and errors are replaceable with a faster and more accurate lending process.

AI in Lending for Smarter Decision-Making

- Leveraging AI-powered lending software helps NBFCs analyze creditworthiness, fraud detection, and loan personalization using machine learning algorithms. AI insights can help NBFCs stay competitive and offer customized financial products to their customers.

Cloud-Based NBFC Solutions for Scalability

- Traditional lending processes that rely on manual solutions are now gradually replaced by cloud-based NBFC solutions. For NBFCs, these cloud-based lending solutions create one-stop shopping for scalable, safe, and real-time access to financial data. Through NBFC software, cloud technology has enabled seamless financial operations in multiple branches through third-party integration.

Loan Origination System (LOS) for Faster Approvals

- A loan origination system (LOS) automates the entire initial process, from application submission by the client to the stage of underwriting. Real-time data analytics and risk assessment tools efficiently enhance efficiency in the approval of loans by cutting processing time significantly and increasing customer satisfaction.

Automated Credit Assessment for Risk Management

- The most challenging part of lending is assessing borrower risk accurately. Automated credit assessment uses AI and huge data analytics to consider financial history, employment records, and alternative credit scores. This allows NBFCs to make data-driven lending decisions with minimal risk exposure.

These tools and advanced features of NBFC software make lending solutions so much better for borrowers. How? Let’s learn about it:

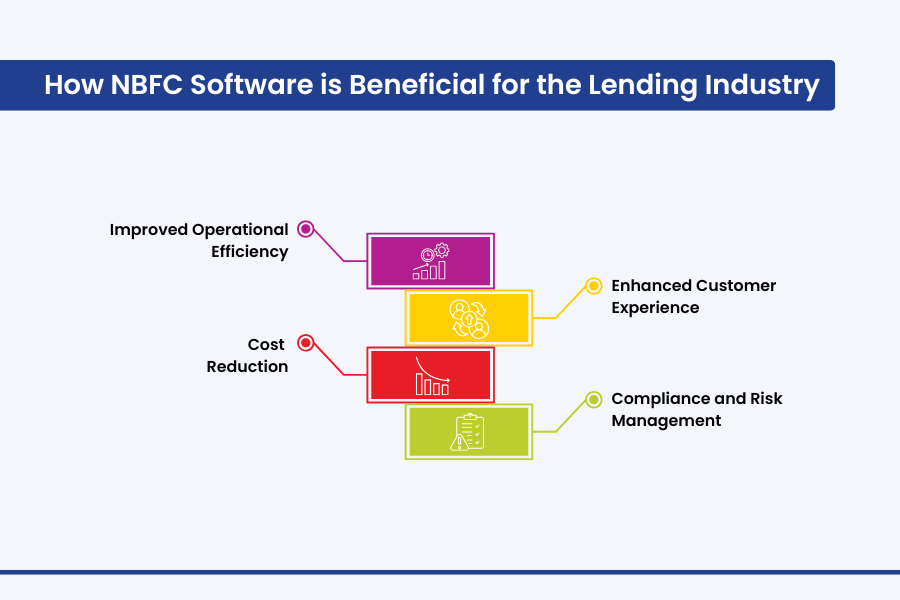

How NBFC Software is Beneficial for the Lending Industry

In the tech-dominated world, let’s understand how NBFC software is capable of setting a benchmark in the lending industry.

Improved Operational Efficiency

NBFCs can optimize their workflow by utilizing cloud-based lending solutions. It allows them to automate multiple lending processes and reduces errors improving productivity.

Enhanced Customer Experience

Using features like instant loan approvals, AI-driven customer insights, and digital loan tracking, NBFCs can support their customers through seamless financial services for borrowers.

Cost Reduction

Moving to cloud-based NBFC solutions can help financial institutions save infrastructure and be more secure with data and compliance.

Compliance and Risk Management

The contemporary NBFC software in India has tools that stick to regulatory compliance and ensure that NBFCs adhere to government norms so that they can effectively handle financial risks.

And with increased efficiency, the benefits are countless. For a better understanding of how integrating NBFC software can bring significant change in processing loans, contact Lendmantra. One of the best NBFC software solutions, that ensures that you deliver the most seamless lending experience to your users. Lendmatra offers customized cloud-based lending solutions, that align with your NBFC requirements perfectly!

The Future of NBFC Software in the Lending Industry

As the evolution of digital lending moves ahead, we can expect that even more technology will play a part in transforming the lending industry. Some of the expected trends include blockchain-powered lending, predictive analytics through artificial intelligence, and biometric approval of loans. Automation in NBFCs will remove inefficiencies and will highly focus on the expansion of portfolios and customer satisfaction.

FinTech is the future of digital lending for NBFCs, as it is expected to provide automated customer-centric lending experiences. By 2025, NBFCs will not have an option except to opt for advanced automation to maintain their sustainability in the growth scale of the industry. But to integrating efficient NBFC software and consulting with a cloud-based lending consultancy becomes a must, and Lendmantra is your ultimate help. We have answers to all your NBFC software-related queries and confusion. Let’s connect!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does NBFC software improve lending efficiency?

NBFC software automates processes like loan processing and analysis of credit risk, and fastens customer onboarding while giving the benefit of minimizing time consumption and human errors. AI-powered lending software and cloud-based solutions for NBFCs ensure real-time decision-making, contributing to an uninterrupted and efficient lending workflow.

What are the key features of modern NBFC software?

Here are some of the key features of modern NBFC software:

- Automated credit assessment:

Uses AI to evaluate borrowers’ creditworthiness and minimize default risks.

- Loan origination system (LOS):

Automates loan application and approval processes.

- Loan management system (LMS):

Manages loan disbursal, repayments, and delinquency tracking.

- AI-powered risk analysis:

Ensures data security, remote accessibility, and scalability.

- Cloud-based lending platforms:

Keeps financial institutions aligned with industry regulations and prevents compliance risks.

- Regulatory compliance automation:

Provides predictive insights for better risk assessment and personalized lending.

- Digital lending integrations:

Enhances user experience through chatbots, mobile apps, and self-service portals.

How does AI impact NBFC lending operations?

AI in lending systems helps with risk assessment, fraud detection, and credit scoring. AI-powered software for lending specializes in ensuring the accurate approval process of loan applications based on the analysis of borrower data by machine learning algorithms. Thus, it maximizes lending efficiency, minimizing defaults, and enhancing the general lending business.

Is NBFC software cloud-based or on-premise?

Most NBFC software solutions in India are cloud-based and hence are more flexible, scalable, and secure. With such solutions, the financial institution can store, manage, and process data in real-time, without having to invest huge amounts in creating an on-premise infrastructure.

Cloud computing allows NBFCs to fetch third-party fintech apps, provides enhanced data protection, and optimizes operational efficiency through automated updates. However, some NBFCs are still following on-premise solutions due to multiple reasons like regulatory compliance, certain security concerns, or just following existing systems. A hybrid NBFC software model is also becoming a popular solution, allowing NBFCs to mark the benefits of both types of models.

How does digital lending benefit NBFCs?

Digital lending has transformed the borrowing experience by making it seamless, clear, and efficient. The major advantages of digital lending for NBFCs include:

- Quick Approvals: An automated workflow and AI-based decisions significantly cut down the time it takes to process a loan.

- Enhanced Borrower Experience: Customers can apply online for loans, track their applications, and quickly get funds.

- Low Operational Costs: Paperwork, manual verification, and administrative prolonged procedures are minimal with automation.

- Scalability: Cloud-based lending solutions allow NBFCs to reach out to a wider and diversified customer base.

- Better Risk Evaluation: AI-based analytics provide precise credit scoring, thus minimizing default risks in loans.

- Compliance with regulations: Adapting to the fast-changing financial regulations makes it easier for an NBFC to keep pace through digital solutions.