“APAC is the fastest-growing region for AI in lending globally, per a 2024-2025 market review,” says the resource. This underscores the shift happening across the region, where digitally engaged populations, regulatory momentum, and rising SME lending are driving adoption of cloud AI platforms.

Driven by evolving customer expectations, competitive pressures, and the need to serve a large underbanked population, these non-banking financial institutions are exploring the power of digital lending paired with AI in financial services to transform how credit is delivered. More specifically, many are embracing a cloud AI platform to empower this shift.

This blog explores why digital lending has become essential, how loan management system solutions empowered by AI are reshaping operations, and why loan management platform capabilities and loan management solutions on the cloud are fast becoming indispensable. Let’s dive into the lending trends shaping this exciting evolution in the APAC and African region.

The Lending Landscape in APAC & Africa

In many economies across APAC and Africa, traditional banking infrastructure has struggled to keep pace with rapid urbanization, rural branch inefficiencies, and the surging demand for credit among micro-enterprises and individuals.

NBFIs, already known for their agility and focus, began exploring digital lending to reach underserved customers. But launching typical digital credit services meant facing high investment barriers, compliance complexity, and separate loan management platform tools.

High mobile penetration opened the door for customers seeking loans, but they had no effective access. Today, customers increasingly rely on mobile wallets for financial services, creating demand for seamless, mobile-first digital lending experiences

To scale, forward-looking NBFIs are adopting cloud-based systems that combine loan management system functionality with AI-driven decision engines. This combination of an AI lending platform and digital infrastructure helps them process applications instantly, manage credit risk, and maintain compliance, all while offering world-class user experiences. But is having digital lending setups enough, or is turning their digital loan systems into effective cloud AI platforms a need of time? Let’s explore.

Why NBFIs Are Turning to Cloud AI Platforms?

Cloud-based digital lending platforms offer NBFI unmatched flexibility. By adopting a cloud AI lending platform, institutions can deploy full loan management system capabilities without heavy infrastructure investment. That means no costly servers, no manual software updates — just instant access to a platform that grows as they do.

Moreover, integrating AI in financial services allows automation of underwriting, fraud detection, and collections. For instance, with a modern loan management platform, loan origination, customer onboarding, risk scoring, and loan management solutions can all be operated within the cloud.

This not only accelerates deployment but also slashes operational costs, vital for NBFIs competing on thin margins. As part of the digital lending journey, NBFCs are leveraging the AI lending platform to deliver personalized rates and real-time credit decisions. It not only benefits them but also helps customers find the personalized loan opportunities regardless of their credit history.

AI-powered analytics on cloud platforms can ingest mobile usage, transaction history, and alternative data to build credit profiles. In APAC and Africa, that means reaching millions of unbanked customers with responsible digital lending solution experiences. That’s why AI in lending is no longer an experiment; instead, it’s rapidly becoming the core of how the modern non-banking financial institutions compete.

Seeing those operational advantages leads us to examine precisely what capabilities a digital lending and AI lending platform brings, and why they’re so transformative. Let’s shed some light on them.

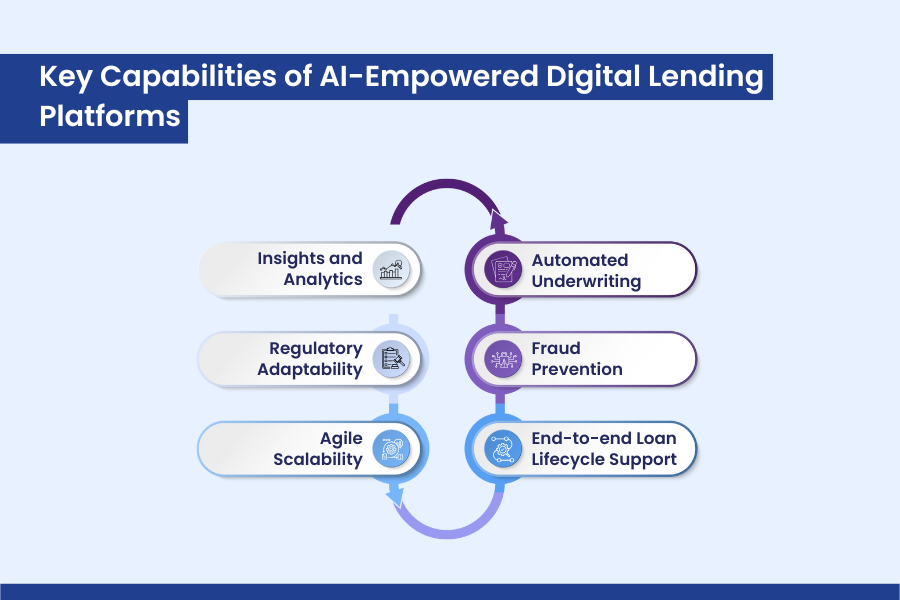

Key Capabilities of AI-Empowered Digital Lending Platforms

A modern loan management system deployed via a cloud AI platform offers several integrated capabilities:

- Automated Underwriting:

AI models analyze data instantly, including payments, social footprints, and smartphone usage, and make real-time decisions, which drive digital lending at scale.

- Fraud Prevention:

AI in financial services detects anomalies and flags suspicious activity early, protecting both the NBFI and the borrower.

- End-to-end Loan Lifecycle Support:

From onboarding through disbursement to repayment, a loan management platform bundled with loan management solutions ensures seamless workflows.

- Agile Scalability:

The cloud AI platform scales up during loan demand spikes, seasonal cycles, or special campaigns, without overprovisioning infrastructure.

- Regulatory Adaptability:

As compliance rules change, updates flow through the cloud, helping NBFIs stay aligned with data privacy and credit-reporting mandates while evolving their digital lending solution.

- Insights and Analytics:

AI delivers dashboards, portfolio risk heat maps, and early warning signals, enabling monitoring and portfolio-level decisions across thousands of loans, all as part of the AI in the loan management process.

These capabilities not only enable better customer experiences (like instant approvals and flexible repayment terms) but also enhance credit outcomes, lower default rates, and build trust, crucial for NBFIs striving to make digital lending both scalable and sustainable.

Conclusion

As we look ahead, the journey for NBFIs in APAC and Africa is unmistakably toward digital transformation, powered by AI and cloud infrastructure. The integration of AI in financial services, loan management platform efficiencies, loan management solutions, and robust cloud AI platform capabilities is redefining how loans are originated, monitored, and repaid.

In embracing AI lending platform innovations and optimizing AI in loan management, NBFIs unlock the ability to reach underserved markets, scale at lower cost, mitigate risk, and enhance customer experience.

As technology evolves, future models, such as embedded credit, on-demand microloans, and real-time portfolio steering, will only deepen the dependence on cloud-native AI-powered digital lending solution frameworks.

Hence, so that you don’t get left behind the pace, Lendmantra is your reliable partner to curate an exemplary cloud AI lending platform. Our experts ensure that you, as an NBFI, don’t just meet the modern loan seeker requirements, but also create a dominating impression in the APAC & African region as an individual organization.

By embedding loan management solutions and AI at the core of lending operations, we help you close the financing gap, serve customers better, and build stronger, more inclusive financial ecosystems today and into the future. Initiate this journey by taking your first step towards making a global impact. Click to connect with our professional!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does AI help NBFCs approve loans faster?

AI significantly helps NBFCs in approving loans faster by automating the entire lending process. It includes credit scoring, verifying documents, detecting fraud, assessing risk in real-time, and automated credit disbursement. AI helps NBFIs reduce the manual review time for the lending process and enables faster decision-making.

Is cloud lending safe for storing customer data?

Yes! Cloud lending is absolutely safe for storing customer data as these platforms are strongly encrypted, have a multi-factor authentication process, and adhere to data protection regulations such as GDPR or local laws to safeguard customer data.

How does cloud lending reduce paperwork and manual work?

Cloud lending setup digitizes the entire loan process by enabling e-KYC, online document uploads, automated verification, and digital signatures. This digital setup, backed by AI, eliminates the paperwork and reduces manual intervention.

Why are NBFCs in APAC and Africa rapidly adopting AI-driven loan systems?

In these regions, high smartphone penetration, underserved credit markets, and growing demand for instant financing are driving NBFCs to adopt AI-driven cloud loan systems for faster, scalable, and more inclusive lending.