Recently, in India, several key regulatory and financial changes have been observed by the Centre to shape customer transparency, data management, and overall compliance readiness. These updates, though they appear small, can have a significant impact on customers, banks, and financial service providers directly or indirectly.

Effective from November 2025, these changes call for greater clarity from banks and non-banking institutions — not only in how they communicate with customers but also in how they adapt their internal systems to align with new compliance requirements.

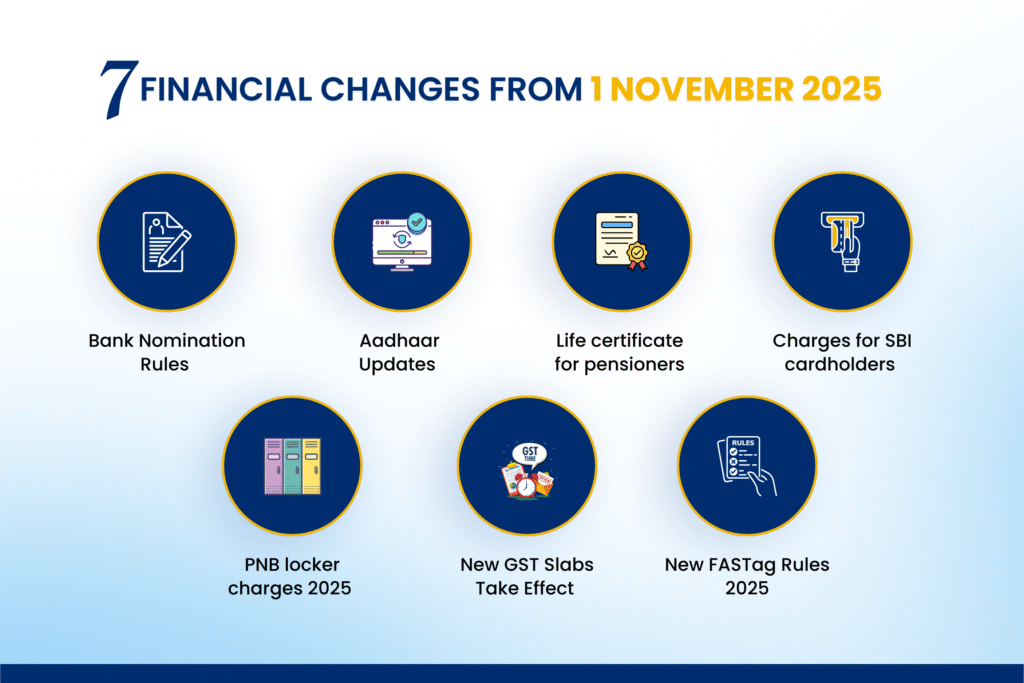

In this blog, we’ve outlined seven major financial changes rolling out from November 2025, with a closer look at the ones most relevant for lenders, NBFCs, and fintech platforms working toward smarter and more transparent financial operations.

7 Financial Changes from November 1

1. Bank Nomination Rules (Effective November 1, 2025)

- The Reserve Bank of India (RBI) has notified the Banking Companies (Nomination) Rules, 2025, and Banking Laws (Amendment) Act, 2025, allowing customers to name up to four nominees for their bank accounts and locker items.

- Customers can now specify both simultaneous nominees — with defined entitlement shares — and successive nominees who inherit in order if a prior nominee is deceased.

- These rules mandate banks to inform customers about the nomination facility while opening accounts, lockers, or safe custody services.

- The amendment also covers safe custody items and mandates that if a nominee dies before receiving funds, their nomination share automatically becomes invalid.

2. Aadhaar Updates

- The Unique Identification Authority of India (UIDAI) has waived off charges for mandatory biometric updates of the Aadhaar for children for a year, while charging 125 INR for adults.

- The adults will also be charged 75 INR for updates to name, date of birth, address, or mobile number, which they can now do online without uploading the supporting documents.

3. Life certificate for pensioners

- Retired central and state government employees must submit their annual Life Certificate by the end of November 2025 to continue receiving pensions.

- They can do this by visiting their bank branch or using the Jeevan Pramaan digital portal.

- Those wishing to migrate from the National Pension Scheme (NPS) to the Unified Pension Scheme (UPS) have also been given time until the end of November to complete the switch.

4. Charges for SBI cardholders

- From November 2025, SBI Card will impose a 1% transaction fee on education-related payments made through third-party apps like MobiKwik or CRED.

- Additionally, a 1% fee will apply to bank wallet recharges exceeding ₹1,000.

5. PNB locker charges 2025

- Punjab National Bank (PNB) has announced a nationwide reduction in locker rent across all categories and sizes.

- The new rates, which vary by locker size and branch category, will take effect 30 days after notification on PNB’s official website.

6. New GST Slabs Take Effect

- Starting November 2025, the government is implementing a simplified GST structure, replacing the earlier four slabs (5%, 12%, 18%, and 28%).

- The 12% and 28% slabs will be removed.

- A special 40% rate will apply to luxury and sin goods such as tobacco, premium vehicles, and aerated drinks.

7. New FASTag Rules 2025

- Vehicles failing the Know Your Vehicle (KYV) verification may face temporary FASTag deactivation, though the National Highways Authority of India (NHAI) has instructed banks to provide grace periods and reminders to ensure compliance.

- From November 15, toll penalties will change: Cash payments will be charged 2× the standard toll fee, and UPI or digital payments without FASTag will attract a 1.25× toll charge.

How New Rules Impact Banks and Financial Institutions?

- Greater Emphasis on Transparent Customer Data Governance

These updates push institutions to digitize legacy documentation and upgrade their core banking and customer management modules for data accuracy and traceability.

- Operational Focus on Auditability and Customer Communication

Banks must now explicitly inform customers about nomination facilities and service options — increasing the importance of digital audit trails for every consent or declaration.

- Improved Asset Tracking and Loan Portfolio Assurance

The new FASTag and KYV compliance norms create an opportunity for vehicle financiers to link verified tag data with loan and collateral records.

- Manual Intervention is no Longer Sustainable

A simplified slab system will help streamline processes, but only if institutions have the flexibility to automatically align their accounting, billing, and processing systems with new rates. So they need a system to comply with ever-changing rules across the organization.

- Need for a Tech Upgrade

The regulatory upgrade of 2025, overall, could lower long-term fraud risks and unclaimed assets (currently ₹67,000 crore in deposits) while increasing upfront tech upgrades and customer outreach costs.

Key Takeaway

The regulatory updates taking effect from November 2025, though varied in nature, reflect India’s shift toward data-driven governance and system-wide compliance. For banks, NBFCs, and fintechs, these changes aim to enhance transparency, reduce disputes, and digitize processes, but they also impose short-term implementation burdens. While collectively emphasizing the need to maintain systems that are not only customer-friendly but also operationally agile and audit-ready.

Platforms like LendMantra, a loan management system and loan origination software solution built for AI-enabled lending automation, already align with this direction — helping institutions modernize compliance processes, automate customer data validation, and stay ready for every regulatory change that comes next. Let’s connect to support you with a tech upgrade and stay tuned for more such insights.

Source

From Aadhaar to bank rules: 7 major financial changes starting November 1 – India Today

New bank account nomination rules 2025: Has RBI made it mandatory? Check what the latest rule says …