Non-Banking Financial Companies (NBFCs) constantly face high growth targets, shrinking margins, and endless regulatory checks in order to maintain a quality status in the fintech market. Conventional lending systems weren’t made for today’s fast, high-volume, or changing lending environment. As lending demand changes and customers want more digital services, NBFCs are moving to cloud lending to protect their future.

To the rescue comes cloud lending that represents a structural change in how NBFCs originate, manage, disburse, and service loans. By shifting core lending operations to the cloud, NBFIs are achieving two critical outcomes simultaneously: scalable growth and measurable cost efficiency.

This blog explores this transformation and why cloud lending is rapidly becoming a strategic necessity in the lending ecosystem.

The Structural Limitations of Traditional Lending Systems

Traditional lending systems were built for a time when loan volumes were stable, product offerings were limited, and changes happened slowly. Many NBFCs still operate on setups where data is fragmented, reconciliations are done manually, and infrastructure is planned for the highest possible load, even if that level of demand is rare.

This creates real challenges. Any upgrade requires heavy investment, and once capacity is added, it cannot be easily reduced. Launching a new loan product can take months instead of weeks. Connecting with credit bureaus, KYC partners, or payment gateways often turns into a time-consuming and expensive task. As these gaps add up, everyday operations slow down, compliance becomes harder to manage, and customer experience starts to suffer. Cloud-based lending software changes this approach by offering a more flexible, efficient, and scalable way to run lending operations.

What is Cloud Lending Solutions?

Cloud lending solutions refers to delivering lending operations through secure, internet-based infrastructure rather than physical servers hosted on-site. A modern cloud lending platform consolidates loan origination, underwriting, disbursement, repayment tracking, collections, and reporting into a single, unified environment.

Unlike conventional systems, cloud architectures are modular. NBFCs can deploy only the capabilities they need, expand functionality incrementally, and integrate external services through APIs without destabilizing core systems. This modularity is what enables both scalability and cost control for financial institutions or non-banking financial institutions.

How Cloud Lending Solutions Enable Scalability Within Lending Infrastructure?

One of the most immediate advantages of cloud lending solutions is increasing scalability. NBFCs can skip predicting transaction peaks. The cloud adjusts computing power automatically to meet the existing demand, during loan surges, launches, or expansions. This adaptability helps NBFCs in fast-expanding areas such as MSME, consumer credit, or embedded finance, making tech a growth navigator for lending institutions.

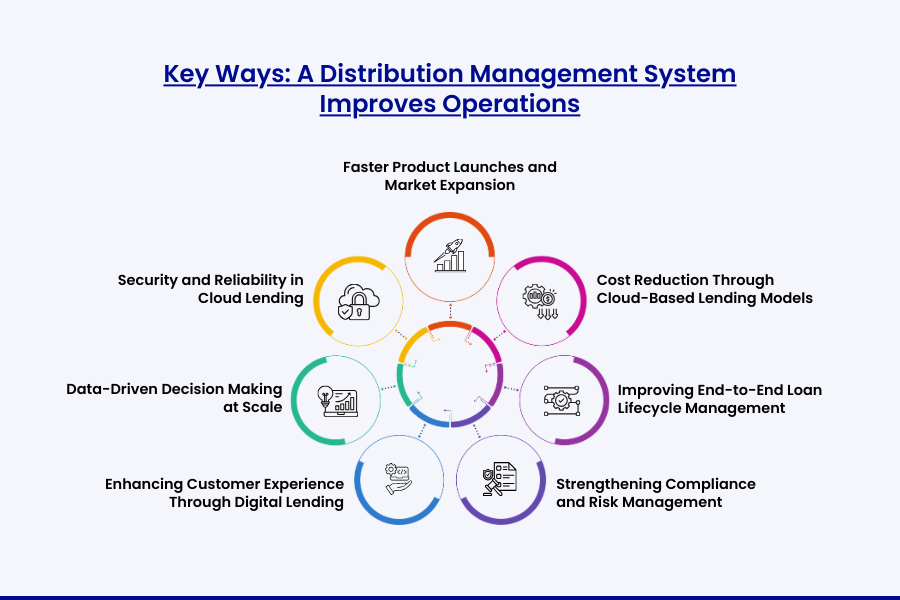

1. Faster Product Launches and Market Expansion

A cloud-based setup makes it much easier and faster to build and roll out new lending features. NBFCs can introduce new loan products, adjust repayment plans, or change pricing without reworking the entire system. Since everything runs on the cloud, updates can be tested and applied smoothly, without long development cycles.

When loan origination software is cloud-enabled, teams can try ideas, make quick improvements, and go live in a much shorter time, often in a few weeks instead of several months. This flexibility matters in competitive markets, where being first to launch or respond to customer needs can directly impact growth and customer acquisition.

2. Cost Reduction Through Cloud-Based Lending Models

- Lower Capital and Maintenance Costs

Traditional on-premise systems require NBFCs to spend a large amount of money upfront on servers, software licenses, and data center infrastructure. This investment has to be made regardless of how much the system is actually used. With cloud-based models, there is no heavy initial setup. NBFCs simply pay for what they use, when they use it, making costs easier to manage and reducing unnecessary financial pressure.

A well-designed cloud-based loan management system eliminates many hidden costs associated with hardware maintenance, system upgrades, and disaster recovery planning. Updates are deployed centrally, security patches are automated, and downtime risks are significantly reduced.

- Optimized Operational Efficiency

Automation is deeply embedded in modern NBFI loan management software. Routine processes such as EMI calculations, payment reconciliation, delinquency tracking, and regulatory reporting are handled by the system with minimal manual intervention. This reduces staffing overheads and minimizes the risk of human error.

Over time, these efficiency gains translate into a lower cost per loan processed, an essential metric for NBFC profitability.

3. Improving End-to-End Loan Lifecycle Management

- Seamless Loan Origination and Disbursement

A cloud-based loan management system for non-banking financial firms puts digital onboarding, credit checks, and approval processes into one smooth operation. Borrowers can apply, send in paperwork, and get approved quickly online, while the firms can see application statuses and risk info clearly.

It works with ID checks, credit score tools, and banking tech to make sure choices are based on data and follow the rules.

- Smarter Loan Servicing and Collections

Loan servicing doesn’t stop with disbursement. Cloud platforms let you see repayment behavior as it happens, allowing you to proactive engage with borrowers. Automated reminders, flexible payment plans, and adjustable collection methods raise recovery rates without adding extra work.

Since the system works in real time, NBFCs can spot trouble early and fix it before problems get intense.

4. Strengthening Compliance and Risk Management

For NBFCs, keeping up with regulations is a never-ending job; hence, cloud lending platforms keep auditability and transparency in mind. The platforms log and traces every transaction, change, and decision, which makes internal audits and regulatory reports easier.

Also, digital lending platforms have rule-based compliance checks. This makes sure lending follows RBI guidelines and constantly changing rules. This lowers the risk of compliance problems and lets teams focus on other crucial tasks instead of doing manual monitoring.

5. Enhancing Customer Experience Through Digital Lending

Today’s borrowers want things to be quick, clear, and easy. Cloud-based lending software helps NBFCs provide simple digital experiences, from applying to completing the loan, without cutting corners on security. Easy-to-use dashboards, alerts, and clear loan tracking create trust and reduce support questions. For NBFCs, this means higher customer retention and brand credibility.

6. Data-Driven Decision Making at Scale

Cloud platforms put all your data in one spot, no matter the product, region, or borrower. Quality analytics and reports show you what’s happening with your loans, risks, and how efficiently operations are performing.

When you can see everything in one place, it’s easier for finance companies to decide on pricing, where to grow, and capital allocation strategies. Such kind of transparent insights are hard to access with legacy, isolated systems.

7. Security and Reliability in Cloud Lending

People often worry about security when considering switching to the cloud. However, the main cloud platforms offer excellent security, with features like encryption, who can access what, and constant monitoring options.

A good cloud lending setup also features robust backup and recovery systems, ensuring your business remains uninterrupted even in the face of unforeseen challenges.

Final Words

For Non-Banking Financial Companies (NBFCs) constantly face high growth targets, shrinking margins, and endless regulatory checks in order to maintain a quality status in the fintech market. Conventional lending systems weren’t made for today’s fast, high-volume, or changing lending environment. As lending demand changes and customers want more digital services, NBFCs are moving to cloud lending to protect their future.

To the rescue comes cloud lending that represents a structural change in how NBFCs originate, manage, disburse, and service loans. By shifting core lending operations to the cloud, NBFIs are achieving two critical outcomes simultaneously: scalable growth and measurable cost efficiency.

This blog explores this transformation and why cloud lending solution is rapidly becoming a strategic necessity in the lending ecosystem.

NBFCs seeking scalable growth without proportional cost increases, cloud lending offers a clear path forward. From flexible infrastructure and lower operating costs to faster innovation and stronger compliance, the advantages are both immediate and long-term.

Lendmantra delivers purpose-built cloud lending solutions designed specifically for the operational challenges of NBFCs. Our unified, secure, and configurable platform enables lenders to modernize their lending stack without disrupting the existing workflow. By combining deep domain expertise with cloud-native architecture, Lendmantra empowers NBFCs to scale confidently, operate efficiently, and compete effectively in a digital-first lending landscape. Are you ready to compete in the tech-driven world? If yes, connect with the experts of Lendmantra now!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does cloud infrastructure support rapid loan processing and growth?

Cloud infrastructure supports rapid loan processing by enabling parallel execution of tasks such as document verification, credit scoring, and approval workflows. APIs and microservices architecture allow multiple processes to run simultaneously without system bottlenecks. This results in faster turnaround times, quicker disbursements, and the ability to launch new loan products or expand into new markets without disrupting existing operations.

Can cloud lending platforms integrate with LOS, LMS, and third-party APIs?

Yes, modern cloud lending platforms are designed for seamless integration with Loan Origination Systems (LOS), Loan Management Systems (LMS), and third-party APIs. They support standardized API frameworks that connect with credit bureaus, KYC providers, banking systems, payment gateways, and analytics tools. This interoperability ensures smooth data flow across systems and enables end-to-end digital lending without manual handoffs.

What role does automation play in cloud-based lending systems?

Automation is central to cloud-based lending systems. It streamlines repetitive and rule-driven processes such as eligibility checks, EMI calculations, repayment tracking, delinquency management, and compliance reporting. Automated workflows reduce human intervention, minimize errors, and ensure consistency across large loan volumes, allowing NBFCs to scale operations efficiently while maintaining control and regulatory compliance.