Recently, the Banking Laws (Amendment) Act, 2025 was notified (with Presidential assent on 15 April 2025) and amends key banking statutes, including the Banking Regulation Act, 1949. A core component of the Act (Sections 10-13) dealing with nomination facilities for deposit accounts, safety lockers, and safe-custody articles has been appointed to come into effect from 1 November 2025. These changes affect not just depositors — allowing up to four nominees and introducing new procedural norms for banks and their systems — but also underscore how banking operations, claim settlement, and nominee records will evolve.

In this blog post, we provide a comprehensive guide to the new banking rules that take effect from November 2025.

What Are the Key Banking Law Changes Coming on November 1, 2025?

The following provisions contained in Sections 10, 11, 12, and 13 of the Banking Laws (Amendment) Act, 2025, are being brought into effect from 1st November 2025 in respect of deposit accounts, articles kept in safe custody, and the contents of safety lockers maintained with banks:

1. Multiple Nominations

Account holders can name as many as four nominees. This will simplify claim settlement for the customer and their nominees.

2. Nomination for Deposit Accounts

Depositors may opt for either simultaneous or successive nominations, as they prefer.

3. Nomination for Articles in Safe Custody and Safety Lockers

For lockers and articles in safe custody, the framework allows only successive nominations.

4. Simultaneous Nomination

When a depositor nominates up to four persons, specifying their percentage share of entitlement for each one, ensuring that the aggregate percentage does not exceed the total of 100%, for transparency.

5. Successive Nomination

Individuals holding deposits, items in safekeeping, or lockers may designate up to four nominees. Each subsequent nominee becomes active only upon the death of the preceding nominee, ensuring smooth settlement and clear succession.

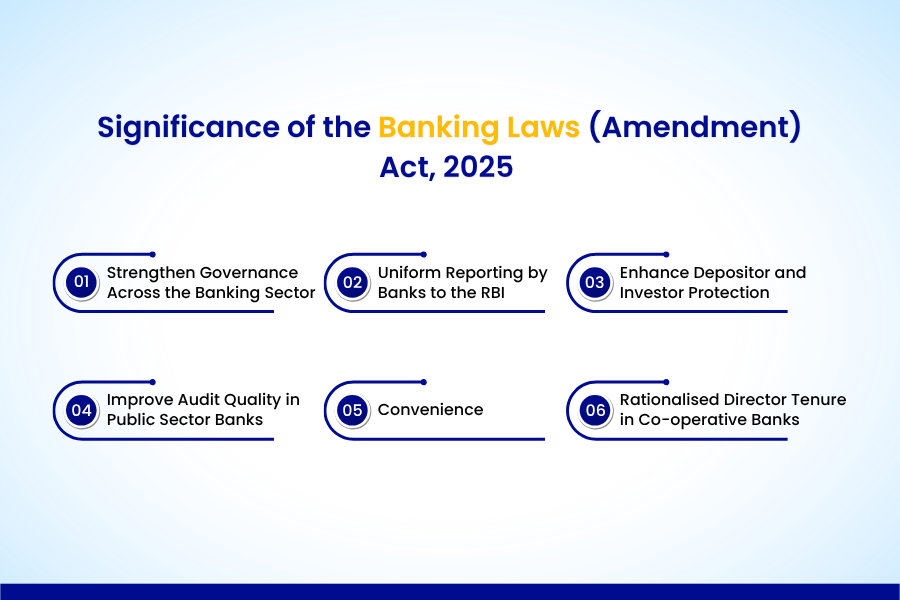

Significance of the Banking Laws (Amendment) Act, 2025

1. Strengthen Governance Across the Banking Sector

The enforced act brings clarity to the tenure and accountability of directors—especially in co-operative banks.

2. Uniform Reporting by Banks to the RBI

With standardised reporting and disclosure by all banks, the transparency and consistency in financial statements and regulatory submissions are also promoted.

3. Enhance Depositor and Investor Protection

The new provisions seek to reduce legal disputes, delays, and fraud risks in inheritance-related banking matters.

4. Improve Audit Quality in Public Sector Banks

The changes in the norms aim to raise the quality and independence of statutory audits in PSBs, curbing governance lapses.

5. Convenience

Promote customer convenience through improved nomination facilities, bringing clarity and traceability.

6. Rationalised Director Tenure in Co-operative Banks

The amendment rationalises the tenure of directors, other than the Chairman and whole-time directors, in co-operative banks.

Who Will Be Affected by the New Banking Law Reforms?

The new provisions coming into effect from November 1, 2025 will touch almost every stakeholder in India’s banking ecosystem — from depositors and locker holders to banks, auditors, and fintech partners:

1. Individual Depositors

Anyone holding a savings, current, fixed, or recurring deposit account will be directly impacted.

2. Locker and Safe-Custody Customers

Customers using bank lockers or safe-custody facilities must now provide nomination details under the revised rules.

3. Heirs and Legal Representatives

The reforms simplify the claim-settlement process for legal heirs and nominees.

4. Banks and Financial Institutions

Banks must revamp their customer-onboarding and record-keeping systems. They also need to train staff and align their workflows with the forthcoming Banking Companies (Nomination) Rules, 2025.

5. Co-operative Banks and Their Boards

With rationalised tenure and governance rules, co-operative banks must review director appointments and compliance mechanisms to meet the amended standards set by the RBI.

6. Auditors and Regulators

Auditors, especially in the public sector and co-operative banks, will have more transparent accountability. Regulators like the RBI will benefit from more uniform reporting and improved oversight.

7. Fintech and Technology Providers

Fintechs such as LendMantra can play a key role in automating nominee management, audit trails, and regulatory reporting.

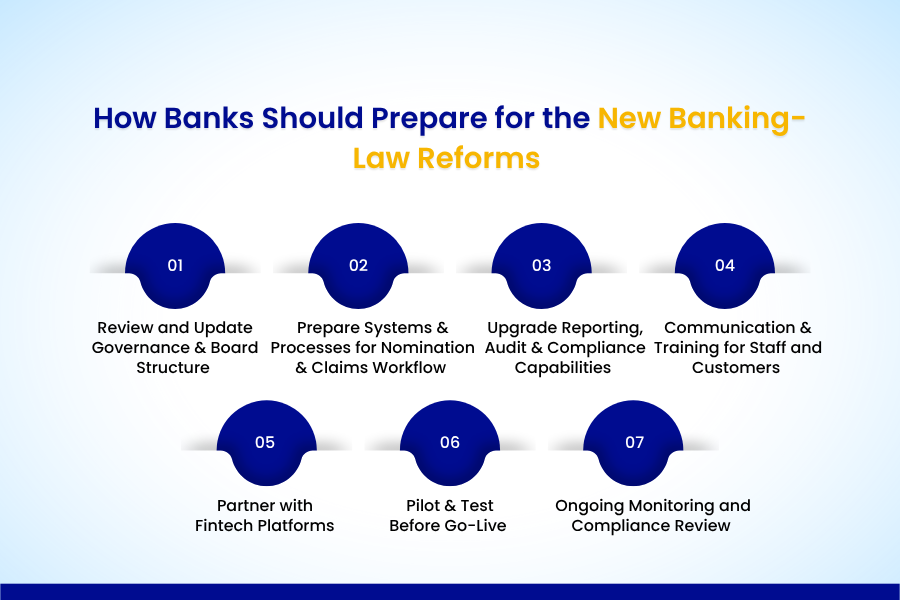

How Banks Should Prepare for the New Banking-Law Reforms

Effective from November 2025, the Banking Laws (Amendment) Act, 2025 requires banks to proactively adapt their operations to meet the new governance, nomination, and reporting requirements. So, to prepare, here are some key readiness actions:

1. Review and Update Governance & Board Structure

- Check board tenures (for directors other than chairman/whole-time directors in cooperative banks) and ensure alignment with the new maximum tenures.

- Review the threshold for “substantial interest” holdings (now raised to ₹2 crore) to identify possible conflicts of interest or required disclosures.

- Update board charters, audit-committee terms, and internal governance documentation to reflect these changes.

2. Prepare Systems & Processes for Nomination & Claims Workflow

- Ensure customer-onboarding systems and account/locker management platforms can record up to four nominees, including percentage shares and succession clauses, for deposit accounts.

- For lockers/safe-custody articles, configure workflows for successive nominations (one after another) rather than only joint nominations.

- Define internal policies and customer disclosures for nomination changes, acknowledgements within three working days, and audit-trail logging.

3. Upgrade Reporting, Audit & Compliance Capabilities

- Adjust reporting timelines: e.g., the revised definition of “fortnight” (first-to-15th / 16th-to-end of month) and shorter submission windows.

- Strengthen audit frameworks: public sector banks will need to engage auditors with higher accountability; ensure internal audit divisions gear up for this.

- Conduct a gap analysis of current disclosures vs. the new obligations to depositors/investors (e.g., unclaimed amounts to IEPF, board governance).

4. Communication & Training for Staff and Customers

- Launch branch/staff training programmes: explain what multiple nominees mean, how nomination workflows will change, and how to handle locker succession claims.

- Banks should provide clear customer communication through leaflets or digital alerts about the new norms on nomination as directed by the RBI.

5. Partner with Fintech Platforms

- Consider technology-partnering to implement modules for nomination-management, multi-nominee data capture, automated claim-settlement workflows and audit logs.

- Use dashboards and alerts to monitor nominations, pending claims, changes in nominee records, and system compliance checks.

6. Pilot & Test Before Go-Live

- Run internal pilot tests of updated systems (nomination flows, reporting modules, audit logs) ahead of the full effective date (1 November 2025 for nomination rules, other sections earlier/gradually).

- Review exceptions, edge-cases (e.g., joint accounts converting to multiple nominees, locker jointly held, succession timelines) to identify operational risk.

7. Ongoing Monitoring and Compliance Review

- Schedule quarterly compliance reports such as nominations processed, claims settled, audit outcomes, board tenure/fit-and-proper checks.

- Maintain a compliance register referencing the Banking Laws (Amendment) Act, 2025, and subsequent RBI/Ministry of Finance notifications, to track future rule-making or phased roll-out.

What’s Next? The Future of Banking

With a significant milestone coming on 1 November 2025—where the nomination provisions under the Banking Laws (Amendment) Act, 2025 will take effect—there remain a few important follow-ups for banks to monitor and act upon:

- The Banking Companies (Nomination) Rules, 2025, and related guidelines issued by the Reserve Bank of India (RBI) are yet to be fully published or operationalised. The main government notification points out that these rules “will be published in due course”.

- Banks should keep an eye on further clarifications from the RBI about timelines for legacy accounts, locker-succession transition, system cut-over dates, and audit-reporting formats. =

- Technology, operations, and audit teams will need to adapt iteratively because the Amendment Act also covers governance, audit quality, reporting uniformity, director tenure changes, etc.

- For banks partnering with fintechs, the coming months represent a strategic advantage: those who align systems, digital workflows, and customer communications early will lead with trust.

In short, these reforms are inevitable, and by adopting upgraded systems, clear nomination workflows, and transparent customer communications, a bank can help its customers and build trust. This is where LendMantra’s fintech modules are designed to adapt quickly: nomination management, audit logs, multi-nominee workflows, and integrated compliance reporting. That means your institution can navigate the reforms smoothly, and so can your customers.

Read More: https://lendmantra.com/blog/

Source:

Press Release: Press Information Bureau

Banking law amendment streamlines succession – The HinduBusinessLine