It’s 2025! Are you still stuck with endless paperwork and waiting weeks for loan approval? Then you must not be aware of Automated Lending in India!

It is too conventional, to still be a part of the traditional lending process especially when we are already excelling in automated lending in India. With the ever-evolving tech and finance industry, have you ever thought of utilizing a mix of both for lending procedures?

Yes! We are talking about automated lending solutions for faster loan disbursements. Primarily if you aim to scale your business in India through an effective finance approach, AI-powered lending solutions should be your first resort. Keep reading, and you’ll find answers to all the baffling doubts, that you might be having reading this.

With multiple lending solutions, finding the right fit for your business can be challenging. This blog elaborates on the hassle-free approach to the digital lending process in India. It is primarily crafted to transform the way NBFC (Non-Banking Finance Companies) can restrain their loan conditions.

Formal Lending Process in India

Before apprehending the evolution of lending technology in India, it is important to learn about how the lending process was initially and why it pivoted to automated lending in India.

Regular bank or financial institution visits, filling vague long forms, constant delays in submitting and approving documents, credit histories, and other such intricacies were never Genz style. Why? Because this entire lending process was inflexible, extremely time-consuming, and steps behind the AI-powered lending solutions.

Hence, the digital-first economy demanded faster, smarter yet more reliable solutions. There enters AI financial services in India, which eased the lending challenges through digital transformation in loan processing. Some of the top platforms like Lendmantra and others leveraged fintech to develop the best-automated lending services and solutions.

How Automated Lending is Transforming The Financial Sector in India?

Before the breakdown are you aware of what automated lending is? No, it’s not just an AI lending solution-

Automated Lending:

This process leverages technology to streamline and speed up the loan process from the initial application stage to the rebate. It minimizes human intervention by incorporating artificial intelligence, and machine learning in lending process. It delivers an improved customer experience and makes lending seamlessly accessible.

Why is it a Hassle-Free Solution?

Loan automation software computerized the entire lending process, including borrower assessment, credit scoring, and risk analysis. It further provides faster, accurate, and more inclusive financial solutions accustomed to borrower’s requirements. Such systems are designed to consider traditional metrics and alternative data sources. These sources can be payment histories, employment trends, or social behaviors. Utilizing these sources the platforms expedite the approval process unveiling the financial possibilities for anyone who might have lacked previous credit histories.

What does the Current Status Have to Say About the AI-powered Lending Solutions?

Before plunging into the attributes of Automated lending in India, let’s see what facts say about this revolutionary swift to the digital transformation in loan processing:

Reasons for Adoption:

- Accuracy and Efficiency: The integration of automation into financial services represents a transformative shift, enhancing efficiency, accuracy, and customer satisfaction across various processes. For businesses, it’s a complex operation that requires efficiency, accuracy, and compliance. Modern lenders increasingly rely on technological solutions to streamline this process, reduce manual errors, and improve the customer experience.

- Cost Reduction: By eliminating manual interventions, automated systems have become a cost-effective option.

- Enhanced Customer Experience: By the borrowers, digital platforms are considered the most convenient and accessible option for lending purposes.

Reliability Factor: Traditional Vs Automated Lending in India

- Research and studies show a higher inclination of borrowers towards automated systems if compared to the trading lending process. AI-driven models can approve 44.28% more borrowers than traditional models offering 36% lower Annual Percentage Rates (APRs) says

- Traditional lending can be considered for its human oversight. However, its ability to meet the inclusivity and speed of automated lending systems still lacking.

For an explicit understanding, we have got you the table below. This table depicts a precise position of the diverse aspects of lending in traditional and automated lending in India.

| Aspect | Traditional Lending | Automated Lending |

| Processing Time | Manual processing takes a longer time. | Comparatively less time-consuming due to automation. |

| Approval Rates | Lower with stringent criteria. | Higher, leveraging alternative data for credit assessment. |

| Interest Rates | Due to increased risk margins, IR is potentially higher. | Lower, AI-based credit risk assessment. |

| Customer Experience | In-person interactions might have a higher chance of being inconvenient. | Digital interactions make the process convenient and speedy. |

| Bias and Fairness | Higher rate of biases subjected to humans | Lower biases, data-driven preferences, and possibilities. |

Why is Digital Lending The Future of India’s Financial Ecosystem?

With the exponentially evolving Indian financial ecosystem, the digital lending process in India is one of the emerging aspects of this transformation. Fintech development has eased most lending struggles for people. Let’s briefly discuss the benefits of automated lending, through the below-mentioned facts:

1. Fast & Digital:

The elimination of human intervention makes machine learning in lending or borrowing industry a prominent option. The Digital process eradicates human interaction or constant bank visits, which makes AI-powered lending solutions a convenient choice.

2. Transparency:

Loan automation software allows borrowers to track each stage of the lending process. This makes AI-powered lending solutions a reliable opportunity for New-Gen India.

3. Efficient:

Considering all the above-mentioned factors, automated lending in India is a feasible yet potential choice. Automation cuts manual costs, reduces paperwork, and speeds up the process.

4. Inclusive:

Fintech lending platforms in India or globally, focus on non-traditional AI data factors. It makes loans an accessible option to any individual with limited or required credit histories.

In modern India, people want quick solutions to their problems, and it is the same when it comes to lending challenges. Automated lending in India, has helped most of the Non-Banking Finance Companies with handy lending solutions. Furthermore, where traditional loan services might be concerning in the fast-paced world, cloud-based lending platforms in India provide experiences that exceed expectations.

However, with the fintech development, financial or lending scam-related concerns have increased simultaneously. Then how to find trustworthy AI-driven loan approval systems for new-gen borrowers?

Before signing up for any fintech lending platform, be sure to check the below-mentioned points. A good cloud-based lending platform would always have:

- Seamless Digital Experiences

- Speed of Loan Approvals

- Data Security & Privacy

- Transparency in Loan Terms

- Personalized Loan Options

- Accessible Customer Support

- Flexibility in Repayment

- Reputation and Reviews

- Comprehensive Loan Lifecycle Management

- Integration of Advanced Technology

Multiple lending platforms are highly relied on by new-gen Indian borrowers, one of the top of which is LendMantra. But if online lending is what the future looks like, do banks rely on AI-powered decisions for lending purposes? Let’s See!

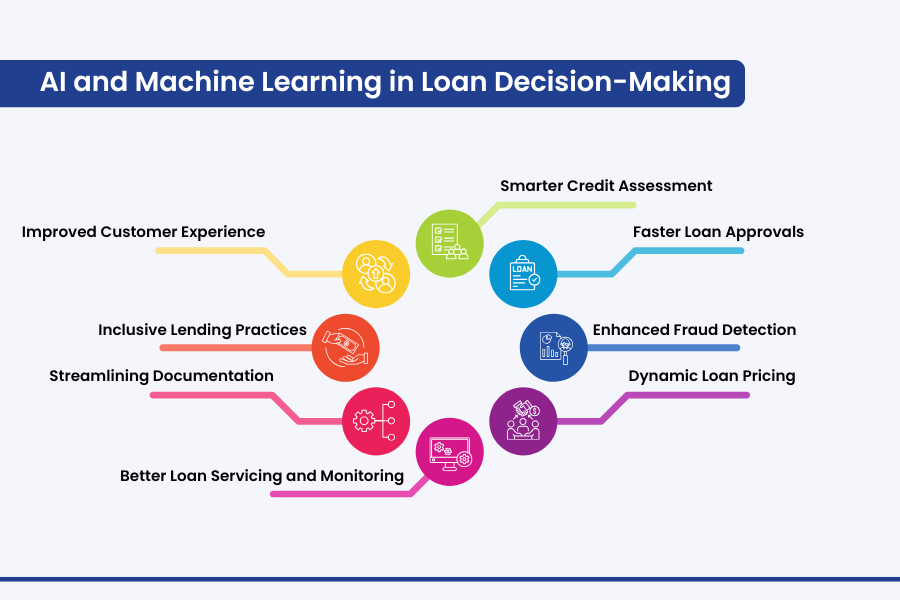

AI and Machine Learning in Loan Decision-Making.

No doubt, fintech has fostered dynamic growth in different financial sectors and even banks couldn’t resist relying on AI and ML for loan decision-making. Here is why:

1. Smarter Credit Assessment:

Unlike traditional systems which highly relied on credit scores and limited data, AI has a vast yet better approach to analyze the same. AI-powered lending solutions scrutinize multiple aspects such as data points, transaction history, spending habits, including social behavior. Qualifying these assessment principles enhances the accuracy of minimizing defaulted profiles and encouraging fair lending practices.

2. Faster Loan Approvals:

Lending technology in India has comparatively simplified decision-making for banks. Where there used to be constant delays, automated systems powered by machine learning are eligible to evaluate and process loan applications within a few minutes.

3. Enhanced Fraud Detection:

Machine learning in lending is one of the potential weapons to identify suspicious patterns that might be a threat or fraud. In fact, with real-time monitoring, the fraudulent activities are detected and resolved before any possible harm.

4. Dynamic Loan Pricing:

No time taking discussions, just quick detail and profile assessment. Loan automation software comprehensively evaluates borrower profiles, market conditions, or risk factors to adjust interest rates dynamically.

5. Better Loan Servicing and Monitoring:

Lending technology in India enables banks to track loan performance and identify early cautions for any misconduct.

6. Streamlining Documentation and Compliance:

Natural Language Processing, automates the verification of documents ensuring they align well with compliance obligations.

7. Inclusive Lending Practices:

An automated process has made lending a non-biased process to any borrower. AI and ML allow banks to extend credits to unbanked or underbanked populations, promoting financial inclusion.

8. Improved Customer Experience:

Cloud-based lending platforms in India have considerably improved customer experience with loans and banks. Leveraging AI chatbots, virtual assistants, and AI-based personalized suggestions have helped borrowers make better decisions and opt for options that fit their requirements the best.

But Wait, You Are Making the Biggest Mistake!

After a comprehensive discussion of Automated lending in India and reading all the beneficiaries, you must be wondering where you have mistaken. The only mistake you are making is not opting for a reliable cloud-based lending platform. Curious to start with one but still not sure about the right platform? Check Lendmantra, a one-stop solution to all your “why”, “how”,” but”, and “if.” In 2025, don’t be deceived by traditional lending patterns to get stuck in the constant delays and never-ending paperwork! Make a smart move, and be a smart borrower, with Automated lending solutions at Lendmantra.

Frequently Asked Questions

How AI is revolutionizing lending decisions in India?

Where AI has significantly revolutionized the tech industry, fintech is no different! The benchmarking shift towards automated lending decisions in India has put the banking and lending industry ahead of the edge. It has not only facilitated the lending process for the NBFCs but also, fasten the approach by identifying the defaulters and the ones who are fairly eligible for credits. Loan automation softwares has eliminated high costs, constant delays in documentation, human interactions, and biased lending access.

What are the benefits of automated lending for banks and NBFCs?

AI-powered lending solutions have significantly benefited banks and NBFCs by streamlining the loan process. Additionally, it has helped them with reduced application or loan approval, improved risk assessment accuracy, lowered human interaction, and expanded customer reach making it inclusively accessible with seamless customer experience.

How does automated lending improve loan processing time?

Automated lending has become a boon in the fintech industry. It has significantly helped borrowers by reducing the time taken for manual data entry, making the verification process seamless, enabling quick credit score assessment, and making near to immediate decision-making possible.

What role does machine learning play in lending automation?

Machine learning a subset of AI plays a crucial role in automated lending solutions for faster loan disbursements. It scrutinizes massive datasets of borrower information to ensure that the credit score aligns with the lending requirements. It allows lenders to make faster yet accurate loan decisions. As machine learning algorithms approve profiles based on borrower’s profile risk analyses, it also reduces human intervention and makes the process seamless yet quick.