Fintech is evolving faster than ever, putting lenders under constant pressure to improve efficiency, reduce risk, and deliver exceptional customer experience that matches the latest market pace.

End-to-end loan lifecycle automation, covering everything from application intake, credit assessment, underwriting, servicing, and collections, is no longer a futuristic module. By 2026 AI and automation will form the foundation of how lending companies operate. This is the reason why, among the enabling technologies, AI in lending has emerged as a transformative force, augmenting human decisions, accelerating workflows, and reducing errors.

But true automation goes beyond plugging in APIs or building quick workflows. To succeed in cutting-edge competition, organizations must follow well-thought-out best practices, aligning people, processes, and technology with their lending expectations. What are these practices are and how do they empower lending executives to perform a robust automated lending process? Let’s explore in this blog.

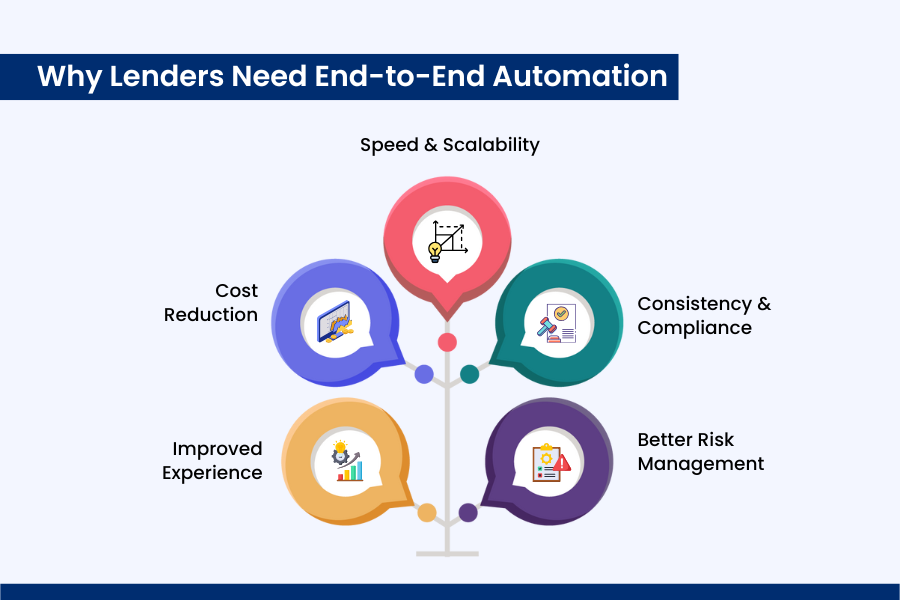

Why Lenders Need End-to-End Automation

Before diving into the best practices for end-to-end loan lifecycle automation, let’s comprehend why it has become extremely essential for the lending industry:

1. Speed & Scalability:

Manual processing is slow and error-prone, especially when volumes surge (e.g., in economic stimulus periods). Automating each loan stage ensures scalability without proportional headcount increases.

2. Consistency & Complianc

While human judgments and analyses might vary, automated decision-making promotes consistency. Coupled with audit trails and rule enforcement, automated lending systems help maintain regulatory compliance and evolve with their changing nature.

3. Better Risk Management:

Real-time data, enriched analytics, and machine learning enable more precise credit evaluation and early warning signals for defaults. That’s where AI in lending plays a pivotal role, by flagging potential risks, allowing lending enterprises to tackle them with precision.

4. Improved Experience:

Borrowers expect fast, transparent, and frictionless experiences. Automation can shorten approval cycles from days to minutes, enhancing competitiveness and customer experience by meeting their demand for quick loan credit access.

5. Cost Reduction:

By reducing manual interventions, rework, and exceptions, lenders can slash operational costs in the long term.

However, many projects stumble due to organizational inertia, data silos, or overreliance on black-box models. So that you do not struggle with these challenges, the following best practices are derived from real-world deployment lessons.

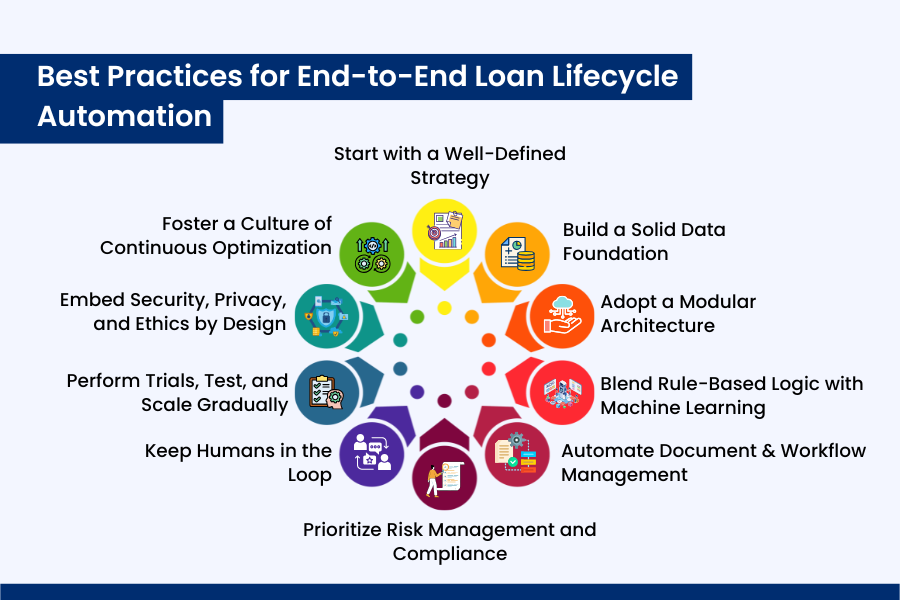

Best Practices for End-to-End Loan Lifecycle Automation

Wondering how the top lending enterprises are succeeding in the industry competition, where other competitors struggle to keep pace with scalability and numbers in revenue growth. Here are some of the best tested practices to follow for end-to-end loan lifecycle automation, which ensures customer engagement, efficiency, and reliability.

1. Start with a Well-Defined Strategy

Every successful automation journey begins with clarity of purpose. Before implementing tools or models, financial institutions must first define:

- The business objective: Is the goal to reduce turnaround time, improve credit accuracy, or cut operational costs?

- The scope of automation: Which parts of the loan lifecycle should be automated first? Origination, underwriting, or servicing?

- The measurable KPIs: Approval rate improvements, error reduction, or enhanced customer satisfaction.

By defining these parameters early, lenders prevent disjointed rollouts. Think of loan automation as an ecosystem, not a single tool. Each process should align with long-term goals, regulatory frameworks, and organizational capacity.

2. Build a Solid Data Foundation

Data is the cornerstone of intelligent lending. Without structured, clean, and contextual data, even the most advanced models fail to deliver accurate results. To successfully implement AI in lending, focus on:

- Data Integration: Connect internal systems like CRM, core banking, and external credit bureaus into a unified platform.

- Data Quality Management: Standardize data formats, remove duplicates, and ensure completeness.

- Feature Enrichment: Incorporate alternative data sources, such as digital payment patterns, behavioral analytics, and transaction histories, to enhance credit insights.

- Data Governance: Establish rules for data lineage, privacy, and access control to ensure regulatory compliance.

Strong data pipelines ensure your loan automation framework runs on reliable, high-quality inputs, driving accurate credit risk models and consistent decisions.

3. Adopt a Modular Architecture

Scalability is the defining trait of any successful automation system. Rather than building monolithic platforms, lenders should embrace modular architectures powered by microservices and APIs.

Each service, application intake, KYC verification, credit scoring, or payment management, should operate independently but communicate seamlessly through secure APIs. This approach enables:

- Quick updates or replacements without disrupting the entire system.

- Smooth integration with third-party services like credit bureaus, e-signing platforms, and payment gateways.

- Flexibility to scale specific components (e.g., risk assessment) during high traffic periods.

This modularity empowers financial institutions to evolve their loan automation system continuously, adapting to new technologies, regulations, or market demands.

4. Blend Rule-Based Logic with Machine Learning

In lending, automation must balance speed with accountability. A hybrid approach, combining deterministic rules and adaptive models, delivers the best of both worlds.

- Rules Engines: Ideal for predictable conditions like age, income thresholds, or employment verification.

- Machine Learning Models: Essential for nuanced analysis, such as predicting default probability, fraud detection, or dynamic risk scoring.

- Governance Layer: Orchestrate how and when each is applied, ensuring transparency and consistency.

- Explainable AI (XAI): Use interpretability tools to justify decisions made through AI in lending, which is crucial for compliance with global regulations.

This rule-model synergy ensures reliability and fairness, vital pillars for building trust in automated decision systems.

5. Automate Document & Workflow Management

A major bottleneck in traditional lending lies in manual document handling. Intelligent document processing (IDP) and Robotic Process Automation (RPA) can revolutionize this stage:

- AI-Powered OCR: Automatically extract information from income proofs, IDs, and bank statements.

- NLP-Driven Validation: Verify extracted data against expected formats, reducing manual review effort.

- Smart Routing: Use RPA (Robotic Process Automation) bots to route applications to relevant teams or systems based on status or exceptions.

- Dynamic Workflows: Allow conditional flows, e.g., direct simple cases to auto-approval while sending borderline cases for manual review.

When powered by loan automation, such systems can cut document processing time from hours to minutes while maintaining absolute accuracy.

6. Prioritize Risk Management and Compliance

Automation does not eliminate risk; it transforms how risk is managed. Institutions must embed compliance and fairness into every stage of the process.

- Bias Detection: Regularly audit algorithms to ensure fair treatment across gender, geography, and income brackets.

- Regulatory Compliance: Integrate AML, KYC, and data-protection checks directly into workflows.

- Transparent Auditing: Maintain decision logs for every automated outcome to support legal and regulatory reviews.

- Model Governance: Use monitoring dashboards to track model drift and ensure periodic retraining.

By embedding these safeguards, AI in lending can enhance transparency instead of obscuring it, positioning automation as a compliance ally rather than a risk.

7. Keep Humans in the Loop

Despite rapid technological advances, human judgment remains irreplaceable in certain lending decisions. Hybrid workflows, where automation handles 80% of the process while humans supervise the remaining 20%, deliver optimal efficiency.

- Escalation Thresholds: Define confidence intervals where human intervention is mandatory.

- Review Dashboards: Give underwriters access to AI-generated insights for informed decision-making.

- Override Logging: Document manual overrides to refine future models.

- Feedback Integration: Feed human feedback into machine learning pipelines to continuously enhance accuracy.

This balance ensures that loan automation remains both efficient and ethically accountable.

8. Perform Trials, Test, and Scale Gradually

Successful automation isn’t about speed; it’s about precision and sustainability. Lenders should roll out automation in carefully controlled phases:

- Pilot Programs: Begin with a specific product (e.g., personal loans) or region.

- A/B Testing: Compare automated vs. manual workflows to measure improvements.

- Performance Monitoring: Track metrics like approval times, model accuracy, and customer satisfaction.

- Scalable Expansion: Gradually extend automation across more loan products once reliability is proven.

A phased rollout minimizes disruption, identifies bottlenecks early, and builds confidence across teams and regulators alike.

9. Embed Security, Privacy, and Ethics by Design

Lending involves handling sensitive financial and personal data; security cannot be an afterthought. To fortify your system:

- Data Encryption: Secure data at rest and in transit.

- Access Control: Restrict permissions based on user roles.

- Ethical AI Policies: Clearly define acceptable uses of borrower data and model outputs.

- Compliance Frameworks: Align with GDPR, CCPA, or region-specific privacy laws.

Ethical and secure AI in lending systems not only protects customers but also preserves institutional credibility in the long run.

10. Foster a Culture of Continuous Optimization

Automation is not a one-time setup; it’s an evolving ecosystem. As borrower behaviors shift and regulations change, so must your systems.

- Ongoing Model Retraining: Use fresh data to maintain accuracy.

- Performance Audits: Monitor KPIs regularly and flag anomalies.

- User Feedback: Encourage underwriters and customers to share insights.

- Tech Refresh: Continuously update architecture, models, and APIs to stay current.

By embedding adaptability into your organizational culture, your loan automation strategy stays resilient and future-ready.

Conclusion

The lending industry stands on the brink of complete digital transformation. With AI in lending driving speed, precision, and personalization, financial institutions now have the power to deliver experiences that are both intelligent and human-centric.

Yet, automation must be pursued responsibly, grounded in data integrity, transparent governance, and ethical practice. The best systems are those that seamlessly blend automation with accountability, speed with scrutiny, and intelligence with empathy.

By adhering to these best practices across strategic planning, data governance, compliance, scalability, and human oversight, lenders can unlock the full potential of loan automation, redefine their operational efficiency, change how the loan origination system (LOS) and loan management system (LMS) function, and lead the next era of intelligent finance. And to achieve this, many lenders and financial institutes trust LendMantra for end-to-end loan lifecycle support. You can also get a demo and pick the module you like to work even smarter.

Read More: https://lendmantra.com/blog/

FAQs:

How does automation improve efficiency across the loan lifecycle?

Automation helps lending companies perform the loan lifecycle at an automated pace, yet with accuracy. It enhances process accuracy and speed, reduces errors, and performs lending tasks, strictly adhering to lending compliance.

What technologies are commonly used in loan lifecycle automation?

The most commonly used technologies in loan lifecycle automation are robotic process automation (RPA), optical character recognition (OCR), and artificial intelligence & machine learning.

How does automation support faster loan approvals and disbursements?

Automation speeds up loan approvals and disbursements by automating data collection and verification, streamlining underwriting with AI, and managing the entire workflow digitally.

What role do AI and machine learning play in loan lifecycle automation?

AI and machine learning play an essential role in loan lifecycle automation by managing data-intensive tasks, credit risk assessment, and compliance checks. This ensures that the lending process not only remains accurate but also adheres to the constantly changing regulatory compliance and meets the loan seekers' demand on time.