Borrowers no longer wait in queues or chase documents across counters. With instant decisions, digital documentation, and mobile-first experiences becoming the norm, the lending experience should also be as effortless as using a food delivery app. Today, the lending relationships are more about creating seamless, trust-building, and intuitive digital journeys for borrowers, which are no longer restricted to transactional relationships.

This shift is largely being driven by mobile lending apps, as functional tools and beyond. They perform as holistic digital companions that guide borrowers every step of the way. From application to disbursement, from EMI reminders to personalized offers, a well-designed customer-facing mobile app is a wholesome experience.

And it’s not just about “great UX.” A well-designed borrower app directly impacts approval rates, repayment discipline, and even retention.

Let’s learn about the customer-facing mobile app features that ensure customers have an exceptional borrowing experience in the blog. But first, why is the borrower experience even important?

Why the Borrower Experience Matters More Than Ever

Today, user experience (UX) is the most valuable asset.

According to a 2023 report by Deloitte, over 70% of borrowers under the age of 40 prefer to interact with lenders through mobile-first solutions. Undoubtedly, it is because this generation (millennials and Gen Z) grew up with apps that respond in seconds, offer intuitive interfaces, and remember users’ preferences. Basically, they compare even the finance app’s performance to that of Zomato, WhatsApp, or Google Pay.

All these expectations come with consequences to many lending institutions, such as:

- For a mobile-centric generation, a poor user experience (UX) can lead to frustration, abandonment, and negative reviews, which is a direct harm to the business’s reputation and bottom line.

- Many digital loan applicants drop off mid-process if the journey feels broken or unclear.

- And it’s not limited to urban or tech-savvy audiences—regional borrowers now demand vernacular content, smart nudges, and real-time clarity on everything from KYC to EMIs.

Lenders who invest in a thoughtful digital lending platform are meeting users’ demands and enhancing their experiences, transforming how borrowers perceive their brand. Where it is challenging for people to understand constantly evolving financial stigmas, having a digital lending system equipped with customer-first features can earn trust faster and retain borrowers longer. To ensure the same customer-facing mobile apps are the game-changer. How? Let‘s discuss.

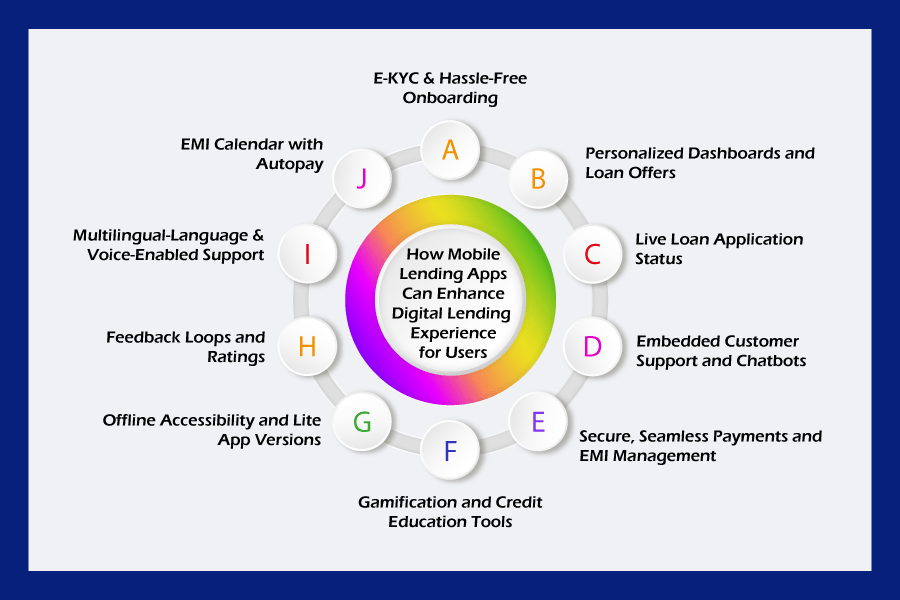

How Mobile Lending Apps Can Enhance Digital Lending Experience for Users

Mobile apps act as the primary interface between lenders and borrowers. But to truly enhance the borrower experience, these apps must go beyond average functionality. They must feel personal, responsive, and intuitive to the users. What features make a customer-facing mobile app truly impactful? Read below:

1. E-KYC & Hassle-Free Onboarding

A well-optimized mobile lending app offers a smooth onboarding process with minimal steps, OCR-based data capture, eKYC integration, and real-time document verification. The more effortless this experience, the higher the drop-off reduction.

2. Personalized Dashboards and Loan Offers

Modern digital lending platforms must leverage data to offer tailored loan suggestions, interest rates, and repayment options based on borrower profiles. When users log in, they should see a dashboard that reflects what they might struggle to search for. It can be their active loans, upcoming EMIs, eligibility, and even recommendations based on behavior or credit improvements.

3. Live Loan Application Status

One of the biggest anxieties borrowers face is the “what now?” phase post-loan application. But not with a robust mobile lending interface that keeps the borrower informed at every step. From document verification to loan approval and disbursement, a perfect lending app features an easy-to-navigate dashboard.

Moreover, adding features like push notifications for EMIs, prepayment options, offers, and reminders helps you create a proactive user experience that puts the borrower in control.

4. Embedded Customer Support and Chatbots

A smart digital lending management solution includes built-in chat support, a mix of AI bots for quick queries, and live agents for complex concerns. The ability to discuss queries, chat in real-time, or request a callback without leaving the app can transform users’ frustration into satisfaction. Moreover, for diverse regions around the globe, regional language options within the app can be a game-changer, especially for Tier II and III users.

5. Secure, Seamless Payments and EMI Management

Apps must offer multiple, secure payment options, UPI, Net Banking, Auto-Debit, and Wallets. Borrowers should be able to schedule EMIs, view due dates, download receipts, and even opt for partial or early repayments with a tap.

6. Gamification and Credit Education Tools

Embedding tools that educate users on what affects their credit score or how they can improve their eligibility acts as a powerful differentiator. You can make these elements engaging through gamification, such as badges for timely EMIs, credit health progress bars, and more.

7. Offline Accessibility and Lite App Versions

In rural areas or regions with uneven networks, digital lending platforms that offer “offline forms” services, local storage, or low-data modes stand out. These small tweaks enhance accessibility and show that the brand understands its borrowers.

Some customer-facing mobile applications, developed by experts like Lendmantra, offer progressive web app versions or Android versions for broader reach.

8. Feedback Loops and Ratings

Smart customer-facing applications allow users to rate their experience, submit feedback, or suggest improvements. This data, when analyzed properly, becomes a goldmine of user insight. It helps refine journeys, fix bugs, and improve satisfaction, leading to better Net Promoter Scores (NPS) and more referrals.

However, having an idea of exceptional features and a customer-centric mobile-facing application is frivolous if not implemented effectively. Hence, to ensure it’s a smooth, scalable, and user-friendly app experience, partnering with a trusted mobile app development company like Lendmantra is imperative.

9. Multilingual-Language & Voice-Enabled Support

In-built multi-language & voice-enabled support helps businesses earn customers from across diverse regions. Hence, it not only allows tech-savvy customers to use digital lending services but also smoothens the digital lending experience for those who are not accustomed to it in their daily lives.

10. EMI Calendar with Autopay

Keeping an EMI track is a headache, but not with custom mobile-facing apps that provide an in-built EMI calendar, giving borrowers a clear view of their EMI dates. Moreover, autopay allows loan borrowers to avoid worrying about missing due dates. It’s just a one-time setting, and their EMI money is deducted from the account without any bounce, lowering their CIBIL score.

11. Reminders & Rewards

Not annoying, but gentle and friendly reminders before every payment, the latest feature updates, rewards, offers, and more can help borrowers stay updated. Moreover, integrating features like “getting paid for rewards” keeps the borrowers inquisitive and committed to paying on time. Rewards like points, cashback, or any other exclusive perks enhance customer engagement with your digital lending platform.

12. Secure Document Vault

Isn’t keeping a track of all your lending essential documents, like the loan agreement, ID proof, and payment recipient, one of the most complicated tasks? But adding a feature like an encrypted document vault in your customer-facing mobile apps can work wonders. This not only helps borrowers to keep their documents secured in one place but also gives them quick and easy access to them. It also performs as one of the significant factors in building brand trust among customers.

Final Thoughts: The Future Is Borrower-Led

The best customer-facing mobile apps are those that anticipate user needs, adapt to user behaviors, reduce call center load, increase repayment discipline, and evolve with user expectations.

With competition rising and attention spans dropping, mobile-first experiences will determine whether people trust and stick to your lending solutions or if they have better options in the market. Efficient digital lending management solutions are the cornerstone to bring a drastic market shift; however, many fail with their right execution strategies.

The best suggestion is to acquire reliable mobile lending app solutions from a trusted platform like Lendmantra that offers custom digital lending solutions to NBFIs, banks, and other financial institutions. As you plan your next update or roll out a new digital lending management solution, the LendMantra mobile app can help you make a market buzz! Let’s connect!

Frequently Asked Questions

How does a mobile app improve the borrower experience?

Mobile apps streamline the lending process by offering speed, convenience, and transparency. Borrowers can complete tasks like submitting documents, checking loan status, and making EMI payments without visiting a branch. Real-time notifications, personalized dashboards, and customer support within the app make the entire journey smoother, faster, and more user-friendly.

What are the key features borrowers look for in a lending mobile app?

Borrowers typically value features like:

- Simple and fast onboarding

- Instant loan eligibility checks

- Real-time loan application tracking

- Secure EMI payment options

- Personalized loan offers

- In-app customer support (chat/call)

- Credit score tracking

- Multilingual support and intuitive navigation

These features make borrowing more accessible and less intimidating.

Can borrowers apply for loans directly through the mobile app?

Yes, absolutely. Most modern mobile lending apps allow borrowers to apply for loans directly within the app. The process usually includes filling out a form, uploading documents, completing eKYC, and receiving instant or quick approval, often without needing any physical paperwork or branch visits.

How do mobile apps support real-time loan tracking and updates?

Mobile apps use automated back-end systems to track the status of a borrower’s loan in real-time. This data is synced to the app interface, where borrowers can view updates like "Under Review," "Approved," or "Disbursed." Push notifications and in-app alerts also keep users informed at each stage, enhancing transparency and trust.