From marketing campaign dates in the digital calendar to keeping a digital track of your EMIs, we have come a long way! Resources predict “The global online loans market reached US$287.5 billion in 2023, and is forecasted to grow to US$756.2 billion by 2033 (CAGR ~10.2%).

The digital revolution in the lending industry has changed how people pursue loans and access capital. Moreover, now loan buyers no longer depend solely on bank agents or physical branches to apply or resolve their loan-related concerns. Mobile-first lending platforms have reduced this dependency by offering instant approvals and addressing customers’ doubts and queries through immediate 24/7 chat and call support.

In this blog, we will discuss how mobile lending is redefining modern finance for the lenders and the buyers.

What Is Mobile Lending?

Mobile lending refers to the process of offering loans through mobile-based platforms and applications, enabling users to apply for, receive, and repay loans from their smartphones. It can range from microloans to larger personal or business loans, all of which are processed digitally.

While mobile lending is often the most visible face of digital lending, it is part of a wider digital lending ecosystem, which includes web-based platforms, AI-powered decision engines, and automated loan management systems that cut down turnaround times from weeks to minutes. If you’ve ever checked your loan eligibility, applied for credit, or paid an EMI using your bank’s app, that’s mobile lending in action.

The Numbers Behind the Digital Lending Boom

According to a report by reports state, “The worldwide digital lending platform market was valued at USD 13 billion in 2024 and is projected to reach approximately USD 39.8 billion by 2033, growing at a CAGR of ~11.9%”

In fact, as per Bain & Company, “India’s digital lending market is projected to reach $1.3 trillion by 2030, from about $270 billion in 2022. Much of this growth is fueled by mobile-first consumers, especially in Tier 2 and Tier 3 cities, who previously found access to credit challenging.” Also, “mobile lending platforms have helped bring over 40 million first-time borrowers into the formal credit ecosystem in India alone,” according to RBI data.

These numbers will continue to grow in the future with a more efficient digital lending setup for NBFIs and their customers. But how is this digital lending, or say mobile lending, making the lives of loan buyers convenient? Let’s see!

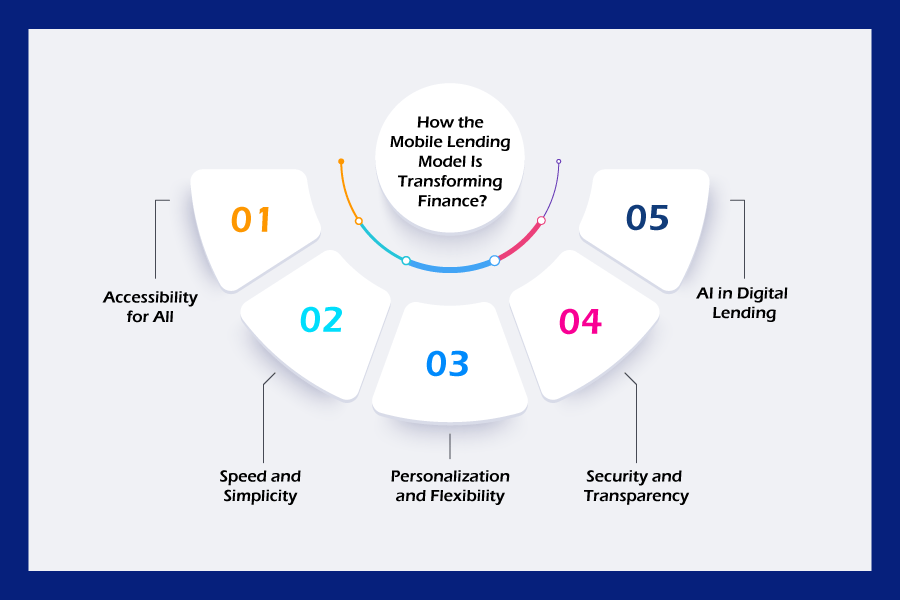

How the Mobile Lending Model Is Transforming Finance?

With the tech-integrated lending model, loan accessibility and fund disbursement have become really easy. Moreover, it has also helped NBFIs with offering:

Accessibility for All

Unlike traditional NBFC lending setups, digital lenders don’t insist on a perfect credit history or a salaried job. They use alternative credit scoring models, analyzing mobile usage, bill payments, and social media patterns to assess risk.

This allows small business owners, and even students, who are previously overlooked, to access loan credit.

Speed and Simplicity

In the conventional lending setting, loan approval could take days, sometimes weeks. In the mobile-first model, you can easily apply at your convenience, and the loan would be approved within a few minutes.

This is only possible because of digital lending platforms, which are integrated with automated loan management systems that run 24/7 and perform the lending process seamlessly.

Personalization and Flexibility

Traditional lending was rigid because of fixed tenures, fixed EMIs, and limited human touch. Modern platforms offer custom loan products, where the borrower can choose how much to borrow, how long to repay, and even change payment dates from the app.

Some platforms utilize AI in lending to predict a borrower’s financial history (based on spending patterns or credit utilization) and offer timely restructuring options, often before the borrower realizes they need it.

Security and Transparency

Digital lenders today employ advanced encryption, biometric logins, AI fraud detection, and transparent disclosure systems, often exceeding legacy NBFIs’ systems.

Moreover, borrowers get clear visibility on interest rates, due dates, and penalties, all from their mobile dashboards.

AI in Digital Lending

From assessing creditworthiness to flagging fraudulent behavior or scams, AI is revolutionizing how decisions are made. AI in digital lending enables:

- Credit Scoring for new-to-credit users by analyzing thousands of digital signals.

- Dynamic Risk Pricing that offers different interest rates based on real-time behavioral insights.

- Predictive Default Models that warn lenders about borrowers who are likely to miss payments, allowing preventive measures.

A Walk Through The Mobile Lending Experience

Manual paperwork, constant in-person visits, regular checks for approvals, and many more similar hussles are not required with Mobile lending. In fact, it has eased the NBFIs and the loan buyers with quick, easy-to-navigate, and personalized loan enrollment and credit access. Let’s take a glimpse at how mobile lending works:

Inquiry

Initiating the process from a search engine when a user types, “instant personal loan”. Within seconds, ads and organic results list digital lending platforms that promise “instant approval,” “zero collateral,” and “low interest rates.”

Application

The user clicks on any of the most convincing search results. The app/ platform asks for a few details of the buyer, like name, PAN, income proof, and bank account. No long forms. However, this process does not require any branch visits.

Verification

For further verification, AI does its job at an automated pace. Using APIs, the system pulls CIBIL scores, checks fraud databases, analyzes income consistency, and more. This automated credit analysis is faster than any human underwriter.

Decision

Within minutes, the user receives a loan offer and can accept it, and the funds are disbursed in the quickest time span. In some cases, it is also possible in about 30 seconds.

Repayment

For repayment, EMIs are auto-deducted each month from the loan seeker’s registered account. If there’s a delay, reminders pop up, and options to extend or restructure the loan are offered, again, all through mobile.

This digital lending setup not only reduces risk for lenders but also ensures that NBFIs offer better products to the customers that are tailored to their unique requirements. But with all these efficiencies, what can we expect from mobile lending applications in the future? Let’s decode!

The Future of Mobile Lending

The future of lending is not just digital. It is deeply personalized, data-driven, and dynamically responsive. Some key trends that we can expect to witness because of digital lending solutions include:

Voice-Based Loan Applications

Although most applications are integrating these features, however, they can rise, especially in rural India, where literacy can be a barrier.

Embedded Lending

Buy-now-pay-later (BNPL) at checkout, business credit within e-commerce apps, and more such integrated embedded lending features are expected to rise. They would ensure that your lending experience remains seamless despite of where you are and what your financial history is.

Open Credit Enablement Network (OCEN)

An Indian initiative that helps all types of digital lenders offer loans on equal terms and makes it easier for more people to access credit fairly.

AI Chatbots for Credit Counseling

These AI Chatbots will help borrowers understand financial products, make smarter decisions, and avoid debt traps.

It eventually means that in the future, borrowing will become as seamless as shopping, as safe as banking, and as smart as the tech-driven efficiencies to offer a personalized experience to the users. If we compare the conventional lending setup and what is expected to be witnessed in the future, isn’t it an entirely transformed landscape of finance? It indeed is!

Final Words

As lending becomes faster, smarter, and more accessible, mobile-first solutions have become the demand of changing lending setups. From simplifying application journeys to leveraging AI for better credit decisions, digital lending is effectively reshaping modern finance.

As this transformation continues, businesses need a reliable partner to navigate the shift with more innovative, tech-driven strategies and innovations. That’s where LendMantra comes into the frame. Our experts have developed a digital lending platform for NBFCs or NBFIs, empowering lenders with advanced, secure, and future-ready digital lending solutions. Get started with mobile-first lending using LendMantra to stay ahead digitally. To know more, book a free consultation call with our experts now!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does mobile lending simplify the loan application process?

Mobile lending simplifies the loan application process through by quick loan management process through AI-driven automation.

Is mobile lending secure for submitting personal and financial data?

Yes, the top NBFCs secure their mobile lending platform through advanced encryption and superior security. It makes it safe for the users to submit their personal or financial details digitally in their lending setups.

What are the benefits of mobile lending for NBFCs and fintechs?

NBFCs and Fintechs building AI and ML integrated mobile lending solutions can offer personalized lending services to their customers. It helps them with omnichannel presence (through recommendations) and elevates user experience.

How do mobile lending apps use AI to assess Creditworthiness?

AI automation and machine learning help mobile lending apps assess customers’ creditworthiness. It analyzes users’ data and other behavioral patterns from social media and multiple applications, which helps it to inspect and approve their creditworthiness.