In today’s digital lending landscape, conventional risk assessment models, heavily reliant on historical data and static credit scoring, are no longer sufficient. Borrowers’ financial behaviour can shift rapidly due to changing income patterns, business cycles, or macroeconomic stress, making real-time risk visibility crucial. This is where AI predictive analytics is redefining lending strategies by helping institutions assess creditworthiness, detect early warning signals, and reduce default rates more accurately than ever before.

This blog explores how predictive analytics in lending is enabling banks, NBFCs, and digital lenders to proactively mitigate default risks and control non-performing assets (NPAs) using AI-driven insights.

How AI Predictive Analytics Improves Risk Assessment

Unlike traditional scorecards that rely on outdated financial records, AI predictive analytics allows lenders to evaluate borrowers based on real-time behavioural and financial indicators.

According to research, AI-empowered predictive analytics can achieve better forecasting accuracy (65%) while also making decisions faster (70%). These models use machine learning to assess factors like cash flow volatility, EMI stress ratios, spending behaviour, supply chain dependencies, and even sector-specific market conditions.

By analysing this data before loan disbursement, predictive analytics in finance helps identify high-risk profiles early, reducing exposure to potential defaults. During the loan lifecycle, systems continuously monitor anomalies, such as sudden drops in income or rising credit utilisation, allowing lenders to intervene before repayment failure occurs.

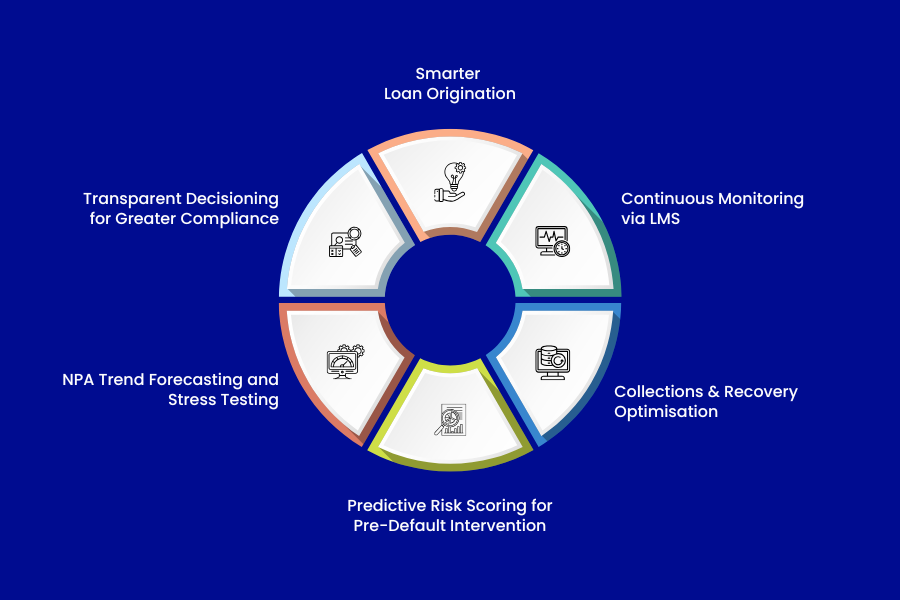

The Role of Predictive Analytics in Lending Lifecycle

Predictive analytics supports lenders at every stage of the loan lifecycle by embedding real-time risk intelligence into each decision. Let’s explore how it functions across different lending phases for more precise risk mitigation.

1. Smarter Loan Origination

AI-based scoring engines integrated within LOS (Loan Origination System) leverage predictive risk modelling to assess eligibility faster and more precisely. Applications flagged as high-risk are rerouted for manual review, while low-risk profiles are auto-approved, accelerating credit operations without compromising compliance.

2. Continuous Monitoring via LMS

Once disbursed, loans are tracked using the LMS (Loan Management System) embedded with predictive risk layers. These intelligent systems detect patterns that may indicate upcoming delinquency, prompting lenders to restructure repayment terms or alert borrowers before EMIs are missed.

3. Collections & Recovery Optimisation

Predictive analytics solutions segment overdue accounts based on recovery potential. Instead of uniform collection strategies, lenders prioritise accounts where timely engagement can prevent legal escalation, reducing operational costs and NPA accumulation.

4. Predictive Risk Scoring for Pre-Default Intervention

AI models generate an updated Probability of Default (PD) score based on ongoing financial updates. Once this score crosses a pre-set threshold, lenders can take informed actions such as restructuring repayment terms, reducing exposure, or increasing communication with the borrower. Instead of re-evaluating loan health after damage is done, predictive analytics enables preventive decision-making, substantially reducing potential defaults.

5. NPA Trend Forecasting and Stress Testing

Predictive analytics examines larger economic variables such as interest rate changes, industry dynamics, and inflation trends to simulate future loan performance. Through scenario-based forecasting, lenders can estimate how vulnerable accounts may respond under different market conditions. This insight supports prudent provisioning and early risk-eliminating approaches, strengthening lenders’ resilience during economic downturns.

6. Transparent Decisioning for Greater Compliance

Regulatory bodies increasingly expect clarity in how lending decisions are made. AI predictive analytics supports regulatory compliance by providing a full data-backed history of risk evaluation and decision-making logic. Audit trails, risk scoring justification, and predictive documentation enable institutions to demonstrate responsible lending practices and avoid regulatory scrutiny.

The Features of Best AI-Powered Lending Platforms & Their Impact

The best AI-powered lending platforms share common attributes:

| Feature | Impact |

| Embedded AI predictive analytics | Automates risk scoring & improves underwriting accuracy |

| LOS & LMS integration | Enables seamless loan lifecycle visibility |

| Scalable architecture | Suitable for banks, NBFCs & digital lenders |

| Regulatory-ready compliance metrics | Supports stress testing, IFRS & RBI mandates |

| API compatibility | Allows integration with external data sources and credit bureaus |

Platforms that combine predictive models with loan management system automation deliver faster disbursals while maintaining strict risk control. These solutions empower lenders to shift from reactive debt management to proactive credit risk forecasting.

Final Words

The lending industry is rapidly shifting toward a predictive, preventive, and proactive model of risk mitigation. With AI predictive analytics, lenders gain the capability to assess risk in real-time, act before delinquency occurs, and optimise the debt lifecycle with greater precision.

When seamlessly integrated within modern loan management solutions, it enhances underwriting accuracy, strengthens portfolio monitoring, enables timely intervention, and significantly reduces NPA exposure.

If you’re ready to build a future-ready lending infrastructure, then Lendmantra has your back! Lendmantra empowers institutions with AI-enabled credit intelligence, predictive risk insights, and adaptive loan management capabilities, helping lenders grow smarter and profitable.

Book a free call with our experts to know more!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions:

Can predictive analytics identify high-risk borrowers early?

Yes, AI-driven predictive models analyse transactional behaviour, income variations, credit utilisation, and sector-specific risks to detect anomalies that precede delinquency. By flagging high-risk profiles before EMI defaults occur, lenders can take preventive action instead of reacting to delayed payments.

How does AI help NBFCs and banks lower their NPA ratios?

AI continuously monitors borrower performance after loan disbursement, generates risk alerts, and recommends corrective strategies such as modifying terms or initiating communication. It optimises recovery prioritisation based on repayment probability, helping NBFCs and banks minimise overdue ageing and prevent loans from being categorised as NPAs.

What are early warning signals (EWS) in lending, and how does AI detect them?

Early warning signals (EWS) are behavioural or financial indicators suggesting potential repayment difficulty, such as irregular cash flows, declining turnover, rising debt exposure, or delayed salary credits. AI detects these signals using real-time data analysis and pattern recognition, enabling lenders to address emerging issues before they escalate into defaults.

Is predictive analytics useful for both secured and unsecured loans?

Yes, in unsecured loans, it helps assess behavioural risk and repayment capability without collateral dependency. For secured loans, it evaluates asset valuation stability, market exposure, and long-term borrower capacity. This ensures accurate risk assessment across both loan types.

Can AI-based predictive models help lenders prevent loan fraud?

Yes. AI can detect inconsistencies in income records, anomalies in application data, falsified documentation patterns, and unusual behavioural trends during onboarding. By validating applicant authenticity and identifying potential fraud indicators early, predictive models support lenders in blocking high-risk applications before disbursal.