Every minute counts in lending. For many non-banking financial institutions (NBFIs) and financial institutions today, borrowers abandon loan applications halfway, KYC checks take days, and risk assessments lack the granularity needed to distinguish high-potential customers from risky ones. With increasing regulatory demands, many fintech competitors are adopting advanced tools, such as AI-driven lending solutions.

This means that AI-powered lending management suites are crucial for staying competitive. From automating customer onboarding to predictive risk assessment and seamless loan disbursement, the integration of AI for lending has reshaped how fintech functions.

In this blog, we will explore how an AI lending platform is transforming the lending ecosystem, improving efficiency, ensuring compliance, and ultimately redefining the future of NBFCs.

The Current Challenges in the NBFC Lending Landscape

Before diving into how AI is reshaping lending, it’s important to understand the key challenges faced by NBFCs and NBFIs today that are encouraging them to shift to a robust digital lending setup:

- High Operational Costs

Manual loan processing, document verification, and compliance checks consume significant time and resources, resulting in NBFIs investing an enormous amount to manage their operations.

- Risk of Defaults

With increasing demand for credit, accurately assessing borrower credibility is a challenge. This results in a higher risk of defaults and financial distress of NBFIs.

- Regulatory Compliance

NBFCs are subject to strict regulatory frameworks that demand transparency and timely reporting. Even a minor violation of these compliances by NBFIs can cost them significant fine charges.

- Scalability Issues

Traditional systems struggle to keep up with the growing loan applications, especially in microfinance and retail lending. When people seek instant services, lending is no exception. Hence, for NBFCs, it’s essential to work with a tech-driven pace to ensure scalability and win customers’ trust.

- Customer Expectations

Borrowers today demand faster approvals, digital onboarding, and personalized financial products. Manual lending is a time-consuming process that makes the customers struggle longer than usual, and it might not be an immediate solution to their urgent financial needs.

This is where advanced loan management software (LMS) powered by AI bridges the gap by ensuring efficiency, accuracy, and scalability. What it is and how it exactly works, let’s learn about it.

What Is an AI-Powered Lending Management Suite?

If terms like loan origination system (LOS), loan management system (LMS), or AI-powered lending management suite still boggle you, then here is what you need to know.

An AI-powered lending management suite is an integrated loan management system designed to automate and optimize the end-to-end lending cycle.

Although they are not the same, they are part of the same mechanism, which in the modern fintech industry is infused with AI specialities to elevate the lending services and customer experience.

AI in loan management helps non-banking financial companies (NBFCs) to analyze large volumes of data in real-time, including credit history, income stability, spending behavior, and even alternative data like utility bill payments or digital imprints. This enables lenders to make faster, more reliable, and customer-friendly lending decisions.

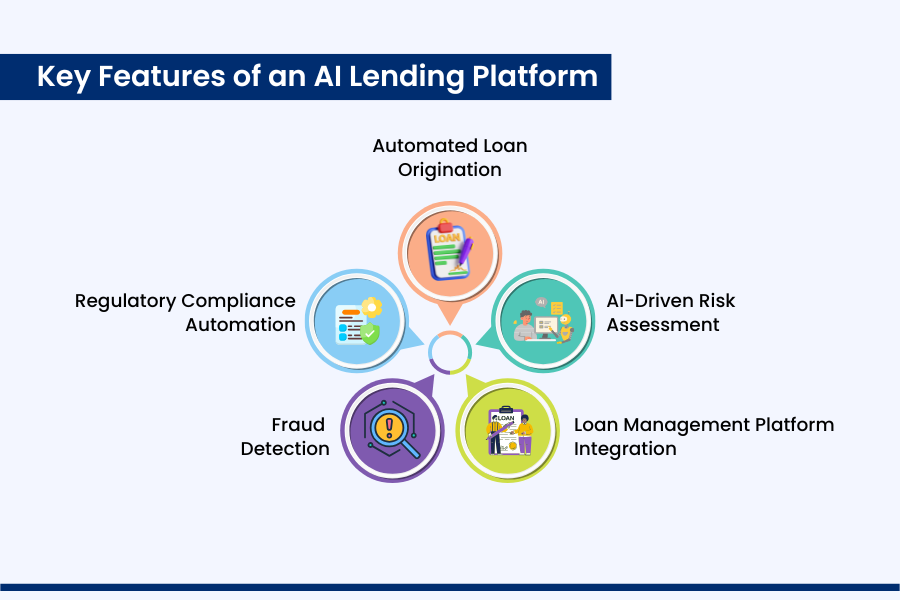

Key Features of an AI Lending Platform

- Automated Loan Origination: Enables non-banking financial institutions (NBFIs) with faster customer onboarding with minimal paperwork while assisting in digital document verification and e-KYC.

- AI-Driven Risk Assessment: Accurate credit profiling through predictive algorithms reduces risks and default rate.

- Loan Management Platform Integration: Unified dashboards for managing loans across different categories, so the employees do not need to juggle between multiple windows.

- Fraud Detection: Identifying anomalies in borrower profiles through AI-powered alerts protects companies.

- Regulatory Compliance Automation: Ensuring adherence to local and global financial regulations protects NBFIs from paying penalties.

These features enable non-banking financial institutions to perform seamless loan disbursement, avoiding fraud or compliance violations. Moreover, AI-integrated LOS/LMS saves massive time and manual workforce, reducing costs that NBFCs can invest in to empower other business aspects. Now, let’s understand the role of AI in transforming the NBFIs’ loan process.

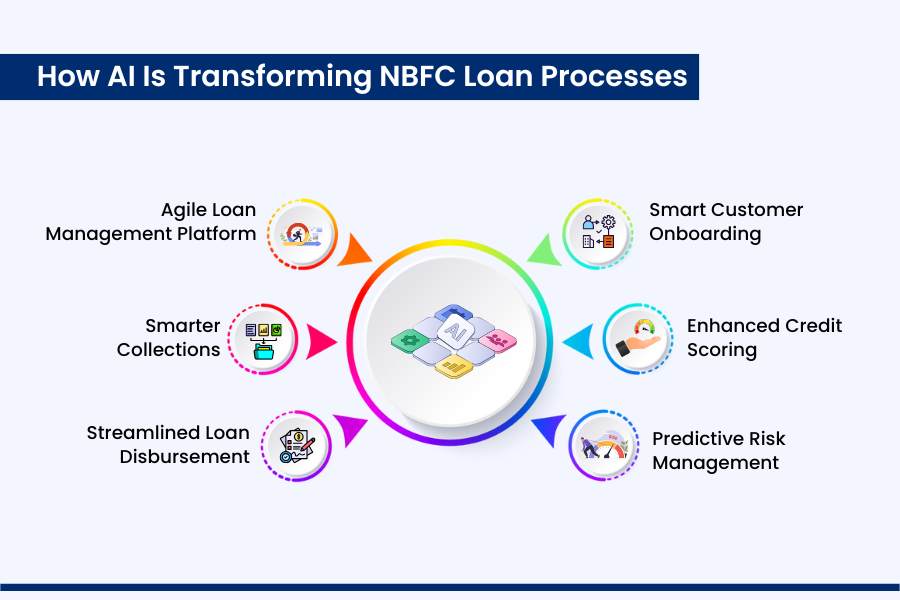

How AI Is Transforming NBFC Loan Processes

Discussing AI in the lending management suite, we have highlighted the challenges of the manual lending process and how AI is reshaping this industry. However, now let’s have a comprehensive understanding of what AI features are empowering lending for both financial organizations and loan seekers.

- Smart Customer Onboarding

Traditional onboarding often takes days, but with loan management software (LOS), customers can complete the lending process within minutes. AI automates KYC checks, identity verification, and background analysis, significantly reducing errors and ensuring faster approvals.

- Enhanced Credit Scoring

AI for lending leverages not just credit bureau data but also alternative data sources like mobile usage, transaction history, and digital payments. This helps NBFCs extend credit to customers with little or no formal credit history, expanding their market reach.

- Predictive Risk Management

An AI lending platform uses machine learning algorithms to predict default probabilities and borrower behavior. This allows lenders to make proactive decisions, mitigate risks, and reduce non-performing assets (NPAs).

- Streamlined Loan Disbursement

With an integrated loan management system, loan disbursals are automated and linked directly to customers’ accounts. This enhances customer satisfaction, reduces processing delays, and eliminates the possibility of fraudulent activities.

- Smarter Collections

AI-powered reminders, personalized repayment schedules, and predictive analytics in loan management solutions (LMS) ensure better recovery rates and improved financial health for NBFCs. The

- Agile Loan Management Platform

Cloud-based loan management systems backed by AI allow NBFCs and NBFIs to operate with agility, ensuring they can scale rapidly without bottlenecks.

A Future Perspective: What’s Ahead of 2025?

The future of lending will look vastly different from today, and AI will be the driving force. NBFCs and NBFIs that adopt a forward-looking loan management platform will thrive, while others risk being left behind. Below is what the road ahead looks like:

- Hyper-Personalized Lending

With AI in loan management, financial products will no longer be one-size-fits-all. Instead, borrowers will be offered dynamic interest rates, customized repayment schedules, and personalized loan products based on their unique financial expenses and behavioral patterns.

- STP across the entire lifecycle

Straight-through processing (STP) is a modernization goal – where an entire loan, from application to repayment, is handled with minimal human intervention. Humans will only step in for unusual or complex cases, while AI manages document verification, KYC/AML checks, disbursement, and collections seamlessly.

- Blockchain & AI Synergy

Smart contracts powered by blockchain will bring transparency and security, while AI ensures real-time execution and compliance in areas such as syndicated loans, collateral management, and escrow disbursements.

- IoT-Integrated Lending Models

Imagine a scenario where a financed asset, like a car or machinery, is tracked in real-time through IoT sensors. AI can utilize this data to assess asset health, adjust risk models, and dynamically secure loan repayments.

- Global Scalability for NBFIs

Cloud-driven loan management software will enable NBFIs to expand beyond regional boundaries, offering cross-border lending capabilities powered by RegTech. Here, compliance checks (KYC, AML, sanctions) are integrated directly into the system and updated in real-time across jurisdictions. This “compliance as code” approach will enable NBFCs to expand globally without being hindered by fragmented regulations.

Takeaway

The transformation of the lending landscape is no longer about whether NBFCs and NBFIs should adopt AI but how fast they can integrate it. An AI-powered loan management suite offers efficiency, transparency, and scalability, three pillars crucial for financial growth in today’s competitive market.

By adopting advanced loan management systems, NBFCs can streamline operations, reduce risks, and meet the growing expectations of digitally savvy borrowers. NBFCs that embrace intelligent loan management software and robust loan management solutions will undoubtedly position themselves as industry leaders in the years to come.

Helping NBFIs across the globe, Lendmantra guarantees that you will lead the fintech as an NBFC with stringent roots, adaptable to the latest technology, and a challenging matrix. Our AI-powered lending management suite empowers your existing lending CRM, providing your organization with a competitive edge in the tech-driven market.

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How does AI improve loan processing and approval times for NBFCs?

Unlike the conventional lending process, AI in LMS eliminates the manual hassle for NBFIs through automation, enabling them to complete the lending process within minutes. The AI-powered loan management system performs automated document verification, instant KYC & customer onboarding, smart credit scoring, predictive risk assessment, compliance-based loan processing, and easy and seamless loan disbursement and collection.

How does AI enhance customer experience in the lending process?

With quick response to customers’ concerns and queries, AI processes lending operations within minutes, rationally adhering to compliance, offering customers an elevated digital lending experience.

What are the key benefits of AI-driven predictive analytics in NBFC lending?

Some key benefits of AI-driven predictive analytics are:

- It enhances data accuracy

- Reduces chances of application errors

- Recommend suitable lending options by analyzing the customer’s past actions.

- Helps NBFIs with improved fraud detection

- Reduces operational costs

- Accurate credit assessment

- Automates underwriting

- Streamlines the Loan Origination Process (LOS) process