While the financial landscape is growing rapidly, the ability to predict and mitigate loan defaults remains a challenge for banking and Non-Banking Financial Institutions (NBFIs). When Non-Banking Financial Companies (NBFCs) extend credit and borrowers’ profiles become more diverse, predicting who might default—and why—has become increasingly complex. Missed repayments not only strain liquidity but also impact profitability and compliance across the financial ecosystem.

Nevertheless, with technology in the financial industry, the AI-driven predictive analytics is starting to make a measurable difference. It enables lenders to identify default patterns that humans might miss, reduce manual underwriting bottlenecks, and help monitor borrowers throughout the loan’s lifespan.

In this blog we will see how predictive analytics in AI actually helps banks or NBFIs with informed decision-making in a loan management software environment. And how lending platforms can integrate these technologies into their loan management systems (LMS).

Why Loan Defaults are Critical to NBFIs

Before delving deep into the “use of AI predictive analytics in LMS,” let’s understand why loan defaults are a crucial topic of concern for banks or non-banking financial companies (NBFCs).

Loan defaults are more than just late payments, as they impact profitability, capital reserves, credit ratings, and regulatory compliance in the following ways:

- When borrowers fail to repay, institutions are forced to set aside additional capital as provision for bad loans, which reduces capital available for new lending.

- Over time, high default ratios can weaken investor confidence and trigger tighter regulatory scrutiny from authorities such as the Reserve Bank of India (RBI), Monetary Authority of Singapore (MAS), South African Reserve Bank (SARB), etc.

To remain sustainable and competitive in a tech-oriented market, financial institutions and NBFCs need an evolved loan management software that can proactively predict and manage these defaults. As traditional risk assessment methods often fail to detect early warning signals, especially for emerging customers or new types of credit. Hence, AI prediction tools are becoming critical as they use diverse data inputs and behavioral patterns to identify risk earlier and more accurately. Now let’s learn about this evolved fintech model and how it works.

What Is Predictive Analytics in Lending?

Predictive analytics refers to the application of statistical models and machine learning algorithms to forecast future events. In lending, predictive analytics estimates the probability of l missed payment (i.e., loan default) or late repayment by analyzing a variety of inputs:

- Credit history,

- Transaction patterns,

- Socio-economic indicators,

- Behavioral signals,

- Alternate external data such as digital footprints or utility bill payments.

By feeding large datasets into machine learning models, NBFCs or NBFIs can generate risk scores not just initially but continuously throughout the entire loan lifecycle—helping them act before a payment problem occurs.

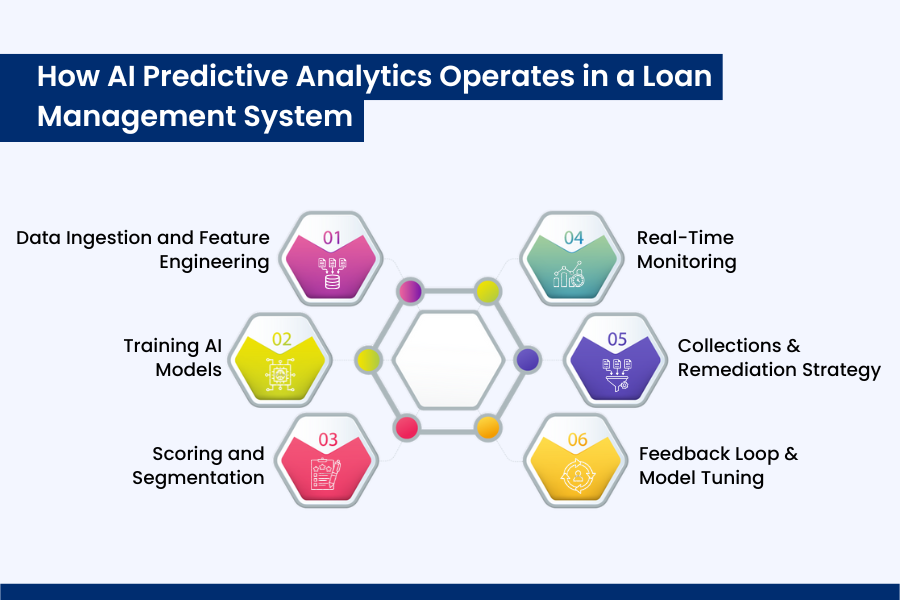

How AI Predictive Analytics Operates in a Loan Management System

Let’s break down how an AI in a loan management workflow typically operates inside a loan management software or a system:

- Data Ingestion and Feature Engineering:

The system collects data from multiple sources: KYC documents, internal repayment history, bank statements, social metrics, mobile usage, or even third-party credit bureau feeds. Using feature engineering, it converts the raw data into variables that correlate with default risk, such as income-to-debt ratios or transaction irregularities.

- Training AI Models:

Historical datasets from NBFC portfolios (both performing and defaulted loans) are used to train machine learning algorithms. Through supervised learning, the model learns patterns that precede a default event. This is the core of AI prediction, estimating the risk score for each borrower.

- Scoring and Segmentation:

Once trained, the model assigns each borrower a risk score. The loan management system integrates this score during underwriting, enabling more fine-grained segmentation: low-risk, medium-risk, and high-risk. This allows NBFC credit committees to approve, reject, or price loans dynamically, under the umbrella of loan automation.

- Real-Time Monitoring:

Credit risk is not static. Through continuous monitoring and tracking changes in borrower behavior or external indicators, the loan management software flags early warning signs. For example, if a borrower’s income flow reduces or other stress indicators emerge, the predictive analytics engine recalculates risk and triggers alerts or remediation options.

- Collections & Remediation Strategy:

When risk thresholds are crossed, the system can automatically invoke preventive actions: offering restructuring options, escalating to collections, or prompting human intervention. That level of AI in loan management ensures a more proactive response rather than reactive write-offs.

- Feedback Loop & Model Tuning:

Every time a borrower defaults, cures, or is restructured, the outcome is fed back to the model. This continuous learning loop improves future AI in lending decisions, making the system smarter over time.

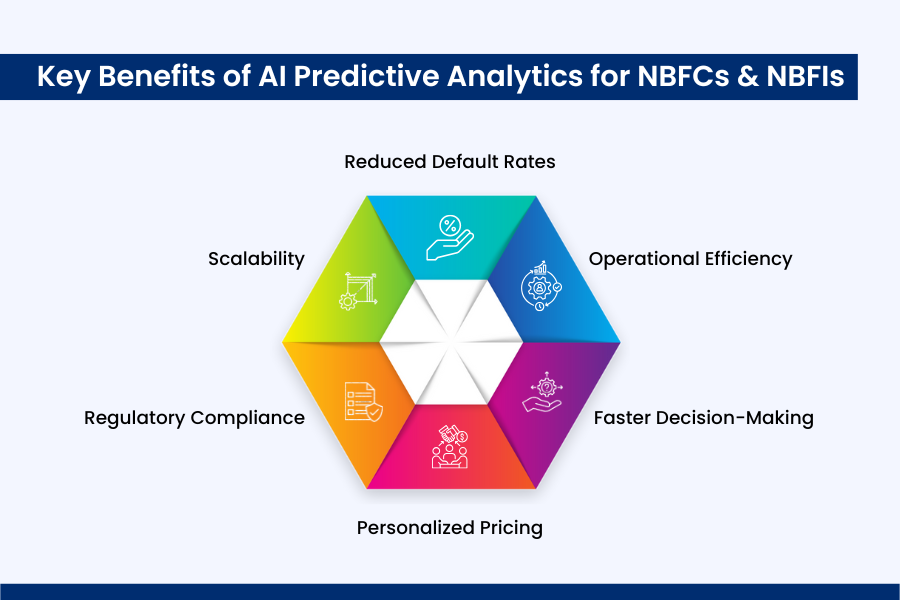

Key Benefits of AI Predictive Analytics for NBFCs & NBFIs

Implementing AI prediction and predictive analytics capabilities within your loan management system delivers multiple advantages:

- Reduced Default Rates:

Better risk evaluation at origination and adaptive monitoring lowers the incidence of non-performing assets.

- Operational Efficiency:

Automated validation, monitoring, and collection triggers reduce manual workload, supporting effective loan automation.

- Faster Decision-Making:

With real-time risk scoring, lenders can accelerate approvals and still uphold rigorous risk and compliance standards..

- Personalized Pricing:

By clearly understanding each borrower’s risk, lenders can set interest rates and loan terms that fit everyone’s lending background more accurately.

- Regulatory Compliance:

Using explainable AI models helps NBFCs present audit-friendly decision trails, supporting compliance with central bank guidelines.

- Scalability:

As portfolios grow, manual processes evolve and challenge; automated scoring scales effortlessly in loan management software infrastructures.

NBFIs, which often cater to borrowers outside the traditional banking system, gain a significant advantage with AI for predictive analytics to manage loan defaults. With the help of alternative data and predictive analytics, they can approve loans for customers who might not qualify through standard underwriting methods.

Challenges & Considerations

While AI in lending and AI in loan management offer tremendous opportunities, implementing predictive analytics to manage defaults comes with its own set of hurdles:

| S No. | Challenge in Predictive Analytics Implementation | Practical Mitigation |

| 1 | Data Quality and Governance | NBFCs must invest in robust data pipelines, consistent formats, secure APIs, and governance policies. |

| 2 | Model Explainability | Use interpretable models or SHAP/LIME techniques to meet audit requirements. |

| 3 | Bias and Fairness | Predictive analytics must avoid unfair discrimination against certain demographics; fairness metrics should be baked into model development. |

| 4 | Integration Complexity | Modernize legacy LMS platforms gradually start with modular APIs and pilot projects. |

| 5 | Cybersecurity and Privacy | Adopt encryption, anonymization, and compliance with RBI & GDPR-aligned policies. |

Mitigating these risks demands a strategic approach such as pilot programs, human-in-the-loop oversight, and cross-functional coordination among risk, compliance, IT, and business teams. This is why partnering with a trusted tech company or adopting AI-powered lending software such as LendMantra is what most financial institutions consider a sustainable alternative.

Conclusion

Modern financial institutions cannot rely solely on traditional credit scoring if they wish to manage default risk proactively. What lenders need today is foresight: the ability to spot early warning signals, act on them quickly, and make data-backed lending decisions with confidence.

Predictive analytics and AI prediction models make that foresight possible. It doesn’t replace human judgment — it sharpens it. By uncovering subtle behavioral patterns, monitoring portfolio health in real time, and learning from every outcome, institutions can move from reacting to defaults to anticipating them. The result not only reduces the likelihood of loan default, but it’s also a more sustainable and transparent lending ecosystem.

As global competition intensifies, lenders that refuse to adopt AI in lending risk lagging behind those that deploy intelligent, data-driven credit strategies. LendMantra bridges this gap by equipping financial institutions, NBFCs, and NBFIs with AI-powered credit assessment, predictive analytics, and real-time risk monitoring. By integrating these tools, lenders can approve loans faster, reduce defaults, and extend credit to borrowers often overlooked by traditional systems. To know more, book a free personalized consultation with out lending software experts now!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions

How can predictive analytics help financial institutions reduce loan defaults?

Predictive analytics helps lenders detect early warning signs of potential defaults by analyzing real-time data and borrower trends. This allows institutions to adjust credit limits, modify repayment terms, or offer proactive support, significantly reducing non-performing loans (NPLs).

Can predictive analytics identify high-risk borrowers before loan approval?

Yes. AI-powered predictive models assess applicant profiles before loan approval, using factors like income stability, credit utilization, and behavioral data to flag high-risk borrowers. This enables lenders to make more informed, data-backed lending decisions.

Is predictive analytics only useful for large banks, or can NBFCs also benefit from it?

Predictive analytics benefits both large banks and NBFCs. While big banks use it for large-scale portfolio management, NBFCs can leverage it to enhance credit assessment, optimize loan automation, and reach underserved customers with reduced risk.

How accurate are AI models in predicting potential loan defaults?

AI models can achieve high accuracy, often above 85-90%, depending on data quality and algorithm sophistication. Continuous model training and integration with real-time data further improve prediction reliability and help institutions minimize loan default risks.