API ecosystem in financial services is an interconnected framework enabling loan providers, fintech platforms, and third-party data sources to collaborate seamlessly. This transformation has significantly elevated how a modern loan management system functions, especially in markets with rapid digital adoption, such as India.

With digital onboarding for smarter lending projected to exceed significant numbers in India by 2030, lenders are compelled to upgrade from legacy processes to smart, unified architectures. This is where APIs step in. They not only integrate diverse systems but also amplify the value of loan management software, bringing speed, reliability, and real-time intelligence into the lending lifecycle.

In this blog, we explore how the API economy is reshaping lending operations, why it has become indispensable, and what it means for the future of the loan management system in India.

- The Growing Importance of an API Ecosystem in Lending

- How API Ecosystems Strengthen Modern Loan Management Systems

- The Indian Context: Why API Ecosystems Matter?

- How API Ecosystems Transform the Loan Lifecycle

- Benefits of an API-Driven Loan Management Platform

- How API Ecosystems Are Shaping the Future of Lending?

- Final Words

- Frequently Asked Questions:

The Growing Importance of an API Ecosystem in Lending

Modern lending depends on how fast and accurately different systems can exchange information. APIs (Application Programming Interfaces) by enabling communication between credit bureaus, KYC platforms, payment gateways, underwriting engines, CRM tools, and external data providers, make it possible, creating a connected workflow.

This interconnected setup defines an API ecosystem, a structured network in which components collaborate to enhance speed, compliance, and user experience. As lenders diversify products (personal loans, BNPL, microfinance, business loans), an API-driven ecosystem ensures that the core loan management system (LMS) can support expanding workflows without compromising efficiency.

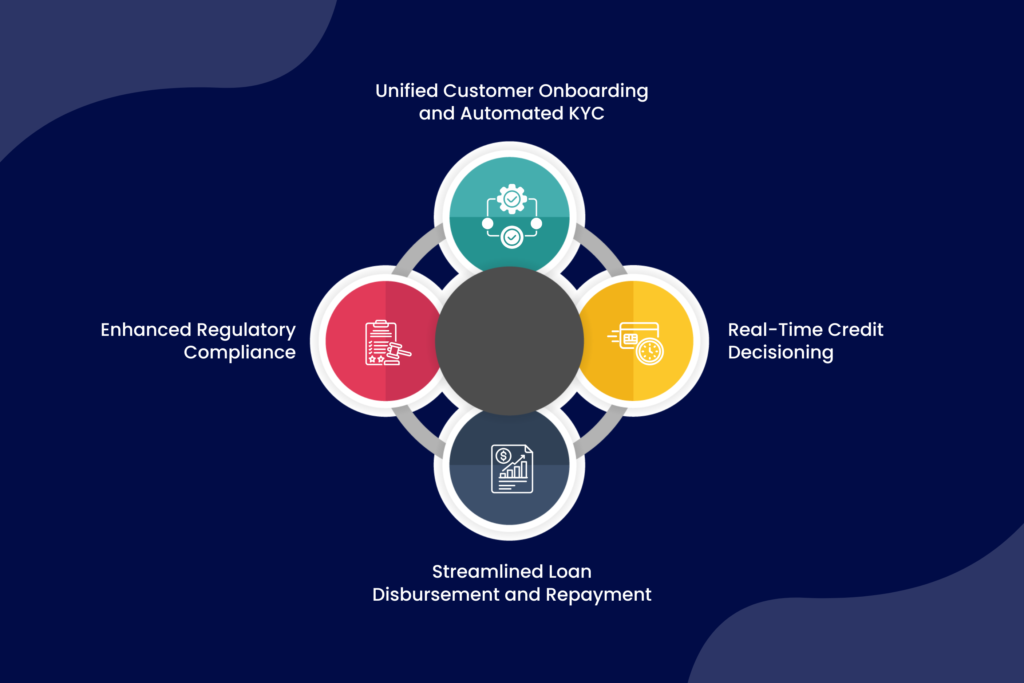

How API Ecosystems Strengthen Modern Loan Management Systems

1. Unified Customer Onboarding and Automated KYC

Customer onboarding sets the tone for the lending experience. APIs enable instant access to PAN verification, Aadhaar authentication, bank statement analysis, e-mandate setup, and credit bureau checks. By integrating these functions directly inside a loan management system, lenders eliminate manual intervention and drastically reduce onboarding time.

For markets such as India, where KYC requirements are stringent, the synergy between APIs and loan management solutions ensures both compliance and convenience.

2. Real-Time Credit Decisioning

Modern lending depends heavily on alternative data, digital footprints, and risk modeling. APIs allow institutions to integrate credit scoring engines, financial statement analyzers, GST data fetchers, and fraud detection systems into their core workflows. Instead of evaluating borrowers through a linear, manual process, lenders can rely on real-time intelligence directly within their loan management software.

This enhances accuracy, reduces default probability, and enables faster loan approvals, benefits crucial in high-volume environments like consumer and SME lending.

3. Streamlined Loan Disbursement and Repayment

Disbursement and repayment operations once relied on disjointed banking systems. Today, lenders integrate their loan management platform with UPI AutoPay, NACH, IMPS/NEFT/RTGS modules, card networks, and digital wallets through APIs. This ensures:

- Instant loan disbursal

- Automated EMI collections

- Real-time reconciliation

- Lower operational overhead

Such automation significantly strengthens the reliability of any loan management system, especially for high-transaction-volume NBFCs.

4. Enhanced Regulatory Compliance

Compliance is non-negotiable in lending. APIs help lenders stay aligned with RBI norms, KYC/AML requirements, bureau reporting structures, and audit trails. Compliance engines integrated through APIs automatically check identity information, trace transactions, and update borrower data within the LMS.

This consistency not only enhances accuracy but also instills greater trust among lenders and borrowers, an important factor when selecting the best loan management system for a regulated market.

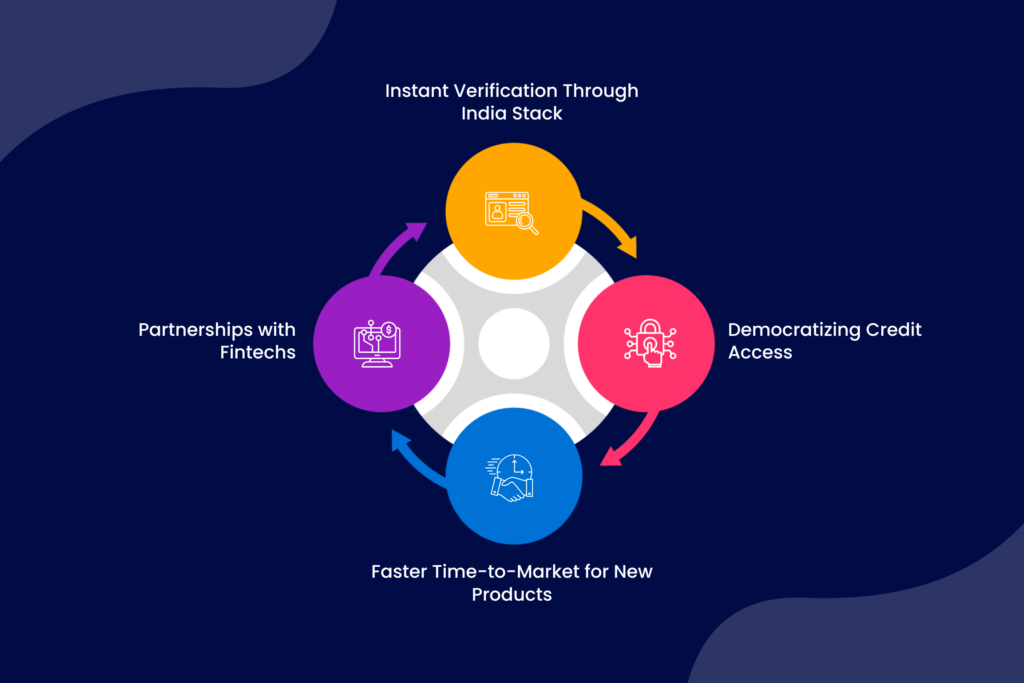

The Indian Context: Why API Ecosystems Matter?

The loan management system in India faces unique challenges: diverse borrower profiles, varied credit needs, and stricter compliance requirements. API-led connectivity resolves many of these issues effectively, such as:

1. Instant Verification Through India Stack

The India Stack, Aadhaar, UPI, DigiLocker, and e-Sign have made API-driven identity and document verification a national standard. A robust loan management platform integrates with these services, enabling instant onboarding and eliminating paperwork.

2. Democratizing Credit Access

Through APIs, lenders tap into alternative data sources such as telecom usage, utility payments, and e-commerce records. This allows NBFCs, microfinance institutions, and digital lenders to assess thin-file customers and expand financial inclusion.

3. Faster Time-to-Market for New Products

Indian lenders are rapidly diversifying into products like BNPL, microloans, and merchant finance. APIs allow quick deployment of new workflows within existing loan management solutions, reducing development time from months to weeks.

4. Partnerships with Fintechs

The rise of embedded finance, loans distributed directly within consumer apps, relies entirely on API connectivity. To stay competitive, lenders need an LMS that enables smooth integrations with fintech partners and marketplaces.

How API Ecosystems Transform the Loan Lifecycle

By integrating external data sources, verification tools, and analytical engines directly into the lending workflow, APIs eliminate operational silos and create a unified, faster, and more accurate lending process. This interconnected framework enhances efficiency at each phase, as discussed comprehensively below.

1. Loan Origination

APIs consolidate data from multiple touchpoints such as application forms, KYC repositories, bank statement analyzers, fraud detection engines, and bureau APIs. With instant verification and data aggregation, the loan origination software process becomes efficient, reducing drop-offs and fraud.

2. Underwriting and Risk Analysis

APIs fetch relevant financial, behavioral, and transactional data. This enables AI-driven underwriting models embedded within the loan management software, reducing human bias and strengthening risk assessment.

3. Loan Monitoring

APIs help lenders track borrower activity, flagged transactions, EMIs, and income patterns. Early warning signals improve loan servicing and allow lenders to address risk proactively.

4. Collections and Recovery

Collections API integrations allow lenders to automate reminders, UPI mandates, NACH (National Automated Clearing House) retries, and payment link triggering. This improves recovery rates without the need for manual intervention.

5. Reporting and Analytics

Through API connectivity, lenders can generate real-time dashboards for regulators, auditors, and internal teams. This brings unprecedented transparency to the entire loan lifecycle.

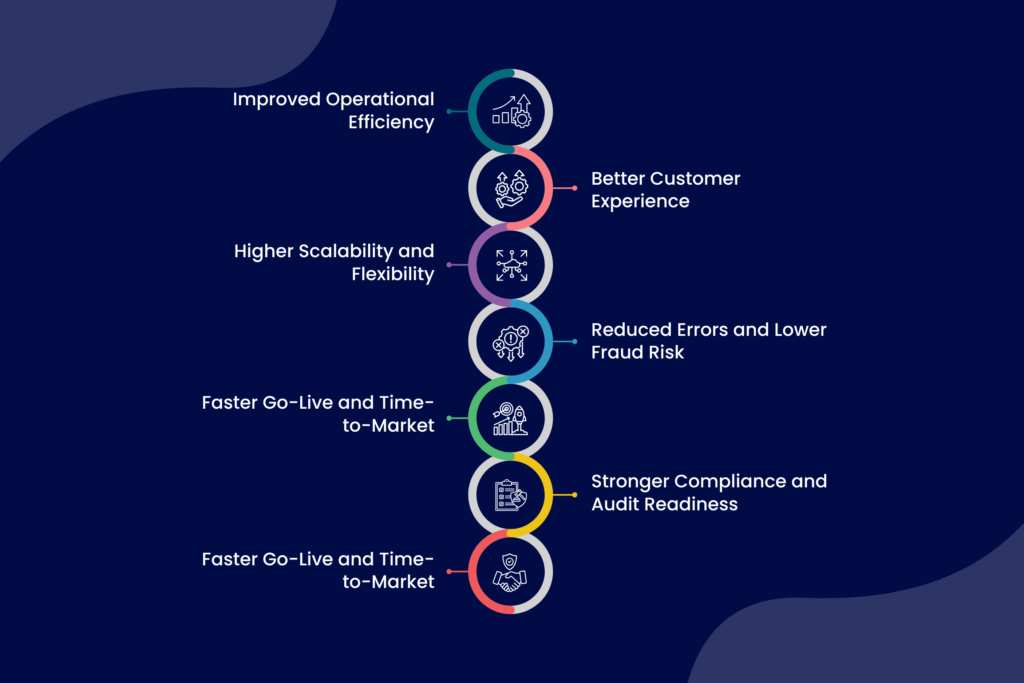

Benefits of an API-Driven Loan Management Platform

As digital lending expands, lenders increasingly rely on systems that can exchange information instantly, adapt to evolving workflows, and support large-scale operations with precision. An API-driven loan management platform enables this transformation by creating a connected environment where data, decisions, and processes move seamlessly across every stage of the lending lifecycle. Here are some primary benefits of having an API driven lending management platform:

1. Improved Operational Efficiency

- An API-driven ecosystem streamlines routine workflows by automating verification, onboarding, and data exchange processes.

- This reduces internal workload and minimizes manual errors that often slow down loan operations.

- As a result, lenders can process higher loan volumes with the same or fewer operational resources.

2. Better Customer Experience

- APIs enable instant KYC checks, faster approvals, and seamless digital interactions across channels.

- Borrowers enjoy quicker turnaround times and more transparent communication at every stage of the loan lifecycle.

- This frictionless experience increases satisfaction and strengthens customer retention.

3. Higher Scalability and Flexibility

- With plug-and-play integrations, lenders can expand into new products or markets without rebuilding core systems.

- The platform can easily accommodate large transaction volumes and support partner-led lending models.

- This level of scalability makes the lending operation future-proof and adaptable to evolving market needs.

4. Reduced Errors and Lower Fraud Risk

- API-enabled data validation ensures that borrower details and documents are authenticated in real time.

- Automated checks reduce the likelihood of manual misentries and identity-related discrepancies.

- Stronger fraud detection tools integrated via APIs provide early alerts and enhance overall platform security.

5. Faster Go-Live and Time-to-Marke

- APIs shorten development cycles by enabling immediate connection to credit bureaus, payment systems, and KYC providers.

- Lenders can roll out new products or features quickly without heavy coding or infrastructure changes.

- This agility enables financial institutions to respond more quickly to market trends and competitive pressures.

6. Stronger Compliance and Audit Readiness

- Compliance APIs help lenders stay aligned with regulatory mandates, reporting rules, and audit requirements.

- Automated logs and real-time data capturing ensure every action is recorded accurately.

- This not only supports regulatory governance but also builds institutional trust and transparency.

7. Seamless Multi-Partner Collaboration

- API ecosystems allow smooth integration with fintechs, marketplaces, aggregators, and embedded finance partners.

- Each partner accesses the loan workflow in real time without operational friction or manual file exchanges.

- This collaboration model unlocks new revenue streams and broadens the lender’s distribution network.

How API Ecosystems Are Shaping the Future of Lending?

The lending market is moving toward a fully digital, hyper-connected model where loan products are embedded in everyday platforms like shopping apps, travel portals, and financial wellness tools. The next evolution of an API-driven loan management system will include:

- AI-powered credit scoring with predictive modeling

- Open banking integrations for richer transaction intelligence

- Auto-decisioning with minimal human involvement

- Cross-border API-standard lending for global borrowers

- Micro-loan and BNPL offerings embedded inside digital commerce ecosystems

In India, particularly, open credit enablement networks (OCEN), Account Aggregators, and enhanced KYC mechanisms are accelerating the transformation. Future-ready loan management solutions must embrace deeper API connectivity to remain relevant in this changing landscape.

Final Words

The era of siloed lending operations is over. Today’s lending ecosystem demands real-time data, automated workflows, embedded finance capabilities, and end-to-end system interoperability. A strong API ecosystem has become the pivot for running a scalable, compliant, and customer-centric lending operation.

The true strength of APIs lies not only in operational efficiency but also in enabling new business models, widening credit accessibility, and accelerating innovation across diverse lending segments. As financial institutions evolve, the depth, speed, and reliability of their integrations will increasingly determine their competitive edge.

This is where platforms like Lendmantra play a transformative role, delivering API-first loan management capabilities built to support NBFCs, NBFIs, banks, and other financial institutions in digitizing workflows, strengthening decisioning, and managing end-to-end lending with greater control and transparency.

The future of lending is one where every workflow and every stakeholder is connected through APIs — creating faster, smarter, and more inclusive financial experiences. With API-enabled partners like Lendmantra, lenders across the spectrum are better equipped to build resilient, future-ready lending operations. Wondering how? To know more, connect with our experts now!

Read More: https://lendmantra.com/blog/

Frequently Asked Questions:

Why are lenders shifting toward integrated LOS + LMS platforms?

Lenders are moving toward integrated LOS + LMS platforms to eliminate operational silos, improve data accuracy, and accelerate turnaround times. A unified system ensures that information flows seamlessly from origination to servicing, enabling real-time visibility, better compliance, and more efficient lifecycle management. This improves scalability and reduces operational costs.

What are the key benefits of using a unified lending platform for banks and NBFCs?

A unified lending platform delivers faster loan approvals, lower processing costs, improved risk management, and stronger portfolio oversight. Banks and NBFCs benefit from a single source of truth, automated compliance, centralized borrower profiles, and AI-driven analytics. This enhances customer experience, reduces NPAs, and supports rapid digital growth.

How does AI enhance credit decisioning in automated lending systems?

AI enhances credit decisioning by analyzing large volumes of structured and unstructured data to assess borrower risk more accurately. It evaluates income patterns, past behavior, digital footprints, and industry-specific indicators to generate real-time credit scores and risk signals. AI models enable faster, more precise underwriting and early detection of potential defaults.

What features should lenders look for in a modern LOS + LMS platform?

Lenders should look for AI-driven underwriting, automated KYC and document verification, configurable rule engines, digital agreements, real-time dashboards, seamless API integrations, collection automation, and strong compliance capabilities. A modern platform should also offer scalability, multi-product support, and a unified borrower view across the entire lending lifecycle.