The onboarding process shouldn’t feel like a visa to Pluto– a process that would take forever to finish. Especially when you apply for a loan, the requirements must be fulfilled within a minimum time. However, NBFC customer onboarding can be extremely time-consuming if not performed using smart resources.

But why would an NBFC customer onboarding process take so long, and how can it be resolved? We will discuss all of that in this blog.

This blog delves deep into the challenges faced in digital onboarding for NBFCs and how they can overcome them with smart solutions.

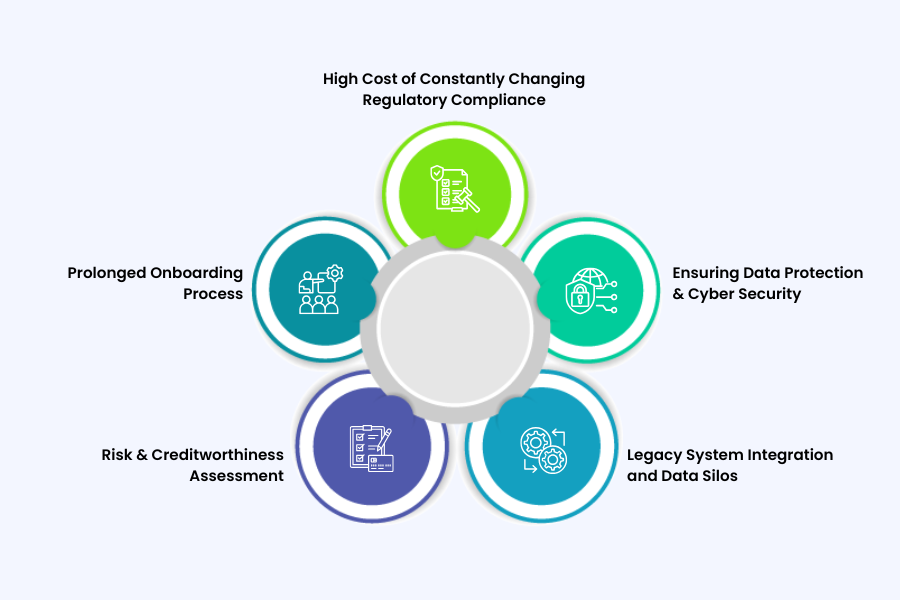

Top 5 Challenges in Onboarding NBFC Customers and Their Solutions

An efficient onboarding process helps a brand to offer a premium customer experience, impacting the brand’s perception, customer retention, and compliance adherence. Here are the top five challenges in the NBFC onboarding process and their practical solutions.

- High Cost of Constantly Changing Regulatory Compliance:

The NBFC landscape is ever evolving, and so are its compliances. The frequent updates in NBFC guidelines and their cost can be challenging to keep up with. Although NBFCs are not subjected to the same stringent compliance as banks, however, the Reserve Bank ensures stability in the NBFC financial system by tightening its regulatory compliance. Hence, guidelines such as stricter capital adequacy norms, asset classification, and provisioning requirements constantly increase the compliance burden on NBFCs. In order to regularly keep up with these compliances, it becomes challenging for NBFCs to ensure a seamless NBFC customer onboarding process.

The Solution: Partnering with a reliable NBFC compliance service provider like Lendmantra can allow businesses to maintain the best regulatory practices. This will also help them to free up internal manual resources, reduce the risk of errors, and ensure a smoother NBFC customer onboarding.

- Ensuring Data Protection & Cyber Security:

With the growing digital threats and scams, ensuring data protection and cybersecurity is crucial. Hence, the more people are relying on digital channels, protecting sensitive user data is paramount for the NBFCs. Even the smallest security data breach can cause severe financial, reputational, and regulatory challenges to the NBFCs. Moreover, integrating comprehensive security measures can be vague, costly, and resource-intensive.

The Solution: Investing in employee training can help NBFCs prevent data breaches and ensure the stringent security of borrowers’ data. Conduct workshops and training sessions on cybersecurity, how to avoid cyber attacks, and data breaches in loan management systems. Secure lending helps NBFCs with

- Legacy System Integration and Data Silos:

Many well-known NBFCs still use isolated databases and outdated core systems. Due to this, NBFCs often face challenges like data discrepancies, duplication, or delays when these systems are integrated with modern digital onboarding platforms.

This results in inefficient data flow in different areas loan management system, like risk, credit, and compliance. It eventually raises operating costs, prolongs turnaround times (TATs), degrades customer satisfaction, and ruins the NBFC customer onboarding process.

The Solution: Utilize APIs and microservices that will help you connect with different systems easily to perform the NBFC onboarding process. Integrate a centralized customer data platform with your loan origination system that will collect data from CRM, loan management, KYC, and analytics systems, working as your single reliable data source. Also, leveraging real-time dashboards can ease the NBFC customer onboarding process by keeping the relevant team members updated on customer insights.

- Risk & Creditworthiness Assessment:

One of the common onboarding issues faced by NBFCs is risk & creditworthiness assessment. Real-time creditworthiness assessment is a significant obstacle in the NBFC customer onboarding process, particularly for first-time borrowers with little to no formal credit history. This results in inefficient decision-making and also increases the chances of lending to high-risk profiles.

The Solution: Utilize alternative ways to assess data scoring, like digital payment history, mobile usage behaviour, etc. Implementing AI/ML models specifically trained for all types of data sets (large or small) can help businesses with real-time credit scores and identify risks.

- Prolonged Onboarding Process:

During NBFC transformation, the customer onboarding process can be extremely time-consuming. This not only makes the customer lose hope and interest in your business but also makes NBFC lose a high number of customers. NBFC KYC verification

The Solution: To ease the NBFC customer onboarding process, NBFCs can automate the customer onboarding process, which will automatically yet efficiently perform NBFC KYC verification, credit assessment, credit underwriting, analyze customer history, approve claims, and more. Automation saves a lot of NBFCs and customers’ time, easing multiple challenges in the NBFC customer journey.

They were just some primarily common onboarding issues faced by NBFCs, but that’s not it! In the regularly evolving lending landscape, the challenges are enormous, and hence, NBFCs look up to potential loan origination systems. Most NBFCs rely on companies like Lendmantra that get you the most reliable and easy-to-navigate loan management systems.

The Takeaway

The world is already at a fast pace, and if your speed doesn’t align with it, you will automatically be out of competition. With so many established and upcoming NBFCs, are your loan origination systems prepared to provide a seamless onboarding experience to the customers? Most loan management systems fail due to inefficient strategy and a conventional NBFC customer onboarding process. However, working in partnership with lending solutions providers like Lendmantra can ease your hassle, enabling you to deliver an exceptional customer experience. Lendmantra solutions are crafted with innovative models that allow NBFCs to make instant decisions making which allows you with a faster yet secure NBFC onboarding process. Your NBFC business can thrive in the digital market with the best Lendmantra solutions.

Connect with our experts now!

Frequently Asked Questions

What role does technology play in solving NBFC customer onboarding challenges?

Technology plays a significant role in NBFC customer onboarding by automating the onboarding process, improving customer experience, identifying the liabilities, ensuring compliance, risk management, increasing customer acquisition and retention, and reducing manual errors. With all of this, utilizing tech, digital onboarding for NBFC ensures that no customer faces any challenges in the NBFC customer journey, and all of them get a superior NBFC onboarding experience.

How can NBFCs ensure data privacy during customer onboarding?

To ensure data privacy during NBFC customer onboarding, they must implement stringent security measures, minimize data practices (only collect the required information, and collect consent-based data. NBFCs must also have rigid data protection policies and tech solutions, ensuring they also adhere to compliance and data protection regulations.

What strategies can NBFCs adopt to reduce the time spent on onboarding?

To reduce time spend on onboarding, NBFCs must adopt AI and machine learning, Robotic process automation (RPA), opt for digital onboarding platforms, perform data analytics to understand customer behaviour, optimize NBFC customer onboarding process, automate risk assessment, execute API integration, and focus on customer experience by utilizing a feedback mechanism and personalized onboarding practices.

How does AI technology enhance the onboarding process for NBFCs?

AI technology enhances NBFCs' customer onboarding process by automating the key processes like document verification, KYC, risk assessment, credit underwriting, chatbots, customer service, operational efficiency, and cost-savings, by finally ensuring they provide a quick yet quality user experience.

What are the benefits of streamlining the customer onboarding process for NBFCs?

Streamlining NBFCs' customer onboarding process helps them with elevated efficiency, cost-saving, improved customer satisfaction, and better brand recognition. However, most importantly, it helps NBFCs with improved customer loyalty and customer retention rate.